| THE WORLD AS WE SAW IT IN APRIL 2024 |

| The World of Cryptocurrencies |

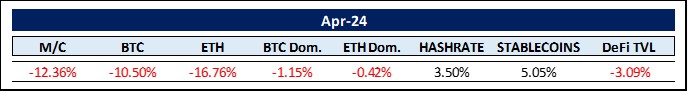

April was a tough month for cryptocurrencies and western stock markets alike. Interest rate cuts that were thought to be certain will either not occur until much later or not at all in 2024. This proved to be poison for all risk-on markets. And anything to do with crypto is still considered very high risk.

Even the long-awaited Bitcoin halving, which took place on April 20, 2024 at 02:09:27, could not stop the slide. The fourth Bitcoin halving has led to a further reduction in the supply inflation rate, with each block now producing half the number of new BTC. This puts Bitcoin’s supply issuance rate below that of gold.

Nevertheless, there has been a monthly outflow of 5,807 BTC from all spot BTC ETFs combined reaching a total holding of 828,285 BTC.

On the other hand, Fidelity Digital Assets has reported a record number of 10.6 million Bitcoin addresses holding BTC worth at least $1,000. This indicates a growing acceptance of Bitcoin among the average population. Despite the recent price drop, industry insiders are not budging from their respective price predictions. To the contrary:

The expected minimum price target for bitcoin is $80,000 in 2024, the average is $87,000 . Markus Thielen from Matrixport expects $125,000, Matiu Rudoplh from Layer One X anticipates a price of $340,000 by the end of 2025, while Gautam Chhugani from Bernstein foresees $150,000 in the same period. Cathie Wood of ARK Invest sees a range of $600,000 – $1,500,000 by 2030 and ultra-bull Michael Saylor has a vision of $5,000,000 per Bitcoin in the same time frame. Interestingly, 47% of experts believe that BTC is currently undervalued, while only 10% think it is overvalued. As smart investors, we should be aware of the one-sidedness of opinions. In any case, contrarian alarm bells should be on high alert.

There are currently 13,476 different crypto projects listed on Coingecko. As the Make-It Fund doesn’t jump on every meme bandwagon, it’s essential to separate the wheat from the chaff. Dominic Williams of the Dfinity Foundation (ICT) agrees, saying that 95% of blockchains are “junk” and the industry seems to care more about narrative than substance: “There’s a lot of confusion today, and people just believe these stories. And I think that’s the biggest challenge facing the industry today”. I look forward to the introduction of some smart regulation reducing the snake oil supply to the crypto-illiterate masses.

Brad Garlinghouse, founder of Ripple, recently prophesied on FOX Business that the crypto markets will double – from a $2.5 trillion total market cap to more than $5 trillion before the end of 2024. He also drew attention to stablecoins. Currently representing some $160 billion in value, he sees this asset class surging to $2.8 trillion by 2028. Paolo Ardoino, CEO of the world’s dominant stablecoin Tether (USDT), chimed in attributing a major chunk of that growth to the new role USD-backed stablecoins play in emerging markets in hedging against local inflation.

It is of course in the interest of the US government that USD-backed stablecoins proliferate, as the recent Lummis-Gillibrand Payment Stablecoin Act shows. These USD-backed stablecoins (USDT, USDC, FDUSD, etc.) ensure the global reserve status of the US dollar when entering the digital world for good. And, perhaps more importantly, such stablecoins are usually backed by US government bonds as collateral. And at a time when there are fewer and fewer buyers of US government debt, this new demand is probably more than welcome and paves the way for hopefully smart regulation of the stablecoin market. And should the stablecoin market reach $2.8 trillion, it would be a bigger factor than China, for example.

Such regulation could also facilitate access for a new group of potential buyers of the dominant cryptocurrencies: The central banks. And an important initiative in this regard comes from a country from which one would not have expected it: Switzerland.

Bitcoin advocates in Switzerland are urging the country’s central bank, the Swiss National Bank (SNB), to consider adding Bitcoin to its reserves. Their aim is to hold a referendum to amend the constitution and make it mandatory for the SNB to hold Bitcoin as part of its reserves. This initiative aims to strengthen Switzerland’s financial independence and neutrality by diversifying its reserves beyond traditional fiat currencies. The last attempt in October 2021 to enshrine Bitcoin as a reserve currency in the Swiss constitution failed due to an insufficient number of signatures for a referendum. However, the current campaign, led by Yves Bennaïm and supported by influential figures such as Luzius Meisser of Bitcoin Suisse, presents more convincing economic arguments. These include the hypothetical increase in national wealth by $32.9 billion if the proposal had been adopted earlier. In addition, there are concerns that a delay in Bitcoin adoption could lead to higher acquisition costs for Switzerland if other central banks include this cryptocurrency in their reserves first.

A final word belongs to Ethereum (ETH). What about the Ethereum ETF? Well, Michael Sonnenshein, CEO of Grayscale, believes that an Ethereum ETF is a question of “when” and not “if”. Sonnenshein points to the strong correlation between the Ethereum spot and futures markets, similar to Bitcoin. JP Morgan agrees. The firm’s analysts recently said that there is a 50/50 chance that an Ethereum ETF will be approved in May. If an Ethereum ETF is not approved by May, they believe that applicants will likely take legal action against the SEC, similar to what happened with Bitcoin.

But there’s another component that seems underreported: demand. Ethereum is an attractive candidate for an exchange-traded fund because it is the leading platform for decentralized applications in finance, gaming, and social media. In other words, its technological focus provides utility and fundamental demand beyond just a store of value.

While Gary is back to full-on “Genslering” (and being sued by Consensys for it), regulators in Hong Kong are showing the way. On April 30, two ETH spot ETFs were launched in Hong Kong (Bosera HashKey Ether ETF (3009.HK) and ChinaAMC Ether ETF (3046.HK)) increasing the pressure on the SEC to make up their mind (demand for the spot ETH ETFs, however, was below expectations reaching only $2.5 million on their first trading day). Gary Tiu, head of regulatory affairs at the custodian firm OSL, described the speed of this approval process in just four months as “mind-boggling” and unprecedented compared to the more than ten- year journey for a Bitcoin ETF in the US.

The World of Commodities

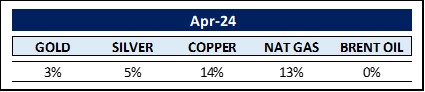

Commodities were the only asset class to buck the downward trend. Copper and natural gas had brilliant months.

Copper futures rose to $10,033.50 on the LME, the highest level since April 2022. According to Olivia Markham, who co-manages the BlackRock World Mining Trust, the price of copper would need to reach $12,000 per ton to spur major investment in new mines and avoid future deficits. This year’s rise has been underpinned by cautious optimism about the global economy, although expectations of lower US interest rates have been put on hold. In China, the world’s largest consumer, growth in the first quarter exceeded estimates, supporting demand. Nevertheless, there is a stark disparity between the upward trend of copper on the futures markets and the depressed conditions on the Chinese spot market. Premiums are falling, inventories are still relatively high and spot prices have been below those of futures for some time, indicating sufficient supply. It is therefore uncertain where prices will head.

Many other metals were also up materially: Lead +11%, aluminum +9%, tin +12%., zinc +15.5%, and nickel +12%. Despite the somewhat gloomy outlook for the global economy, basic materials appear to be working as a hedge against inflation.

Moving on to energy: Although the oil price barely moved in April, the price of Brent crude oil has nevertheless risen by around 12% since the beginning of the year. US crude oil stocks have fallen considerably in recent years. The Strategic Petroleum Reserve (SPR) is currently at 1984 levels, with crude oil (sweet or sour) stored in 62 underground salt caverns at four different locations in Texas and Louisiana. The supply of crude oil in the US SPR is only sufficient for 17 days. Drilling activity has also fallen drastically in the meantime. The number of active wells is only a third of what it was at its peak in 2011, and there are only half as many wells in operation as before the pandemic. Due to political resistance to oil and gas exploration, oil companies are reluctant to spend the money needed to rehabilitate existing wells or drill new ones. Will this backfire?

Coffee prices reached a record high due to concerns about the Brazilian harvest. Due to the heavy rainfall, which was 335% higher than usual in the Minas Gerais region, industry experts fear a supply disruption that will affect prices. Minas Gerais accounts for 30% of Brazil’s annual Arabica coffee harvest, and Brazil is the world’s largest producer of Arabica coffee beans. The world’s largest producer of Robusta beans, Vietnam, has also announced a poor harvest and has reduced production by around 20%. I have heard that yerba mate is also rich in caffeine should you be looking for a substitute 😉

The Rest …

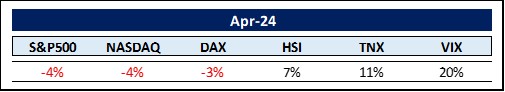

Tiffany Wilding of Pimco was pretty blunt when she reflected on current market movements: “The pivot party from December is over.” So what happened? Wall Street was rocked by data that showed exactly what investors did not want to hear: a sharp slowdown in the world’s largest economy and stubborn inflationary pressures leading to fears of stagflation. The key point that investors have learned since the 1970s is that inflation has a long tail. As soon as prices start to rise and consumers accelerate their purchases, companies take the opportunity to raise their prices. This affects sentiment and reinforces the perception that prices are out of control.

To understand inflation, I prefer to turn to the man who understood it best, the late Nobel Prize-winning economist Milton Friedman. Friedman explained that inflation is always caused by one thing and one thing only… a faster increase in the money supply than in the production of goods and services. It’s as simple as that. Inflation isn’t caused by an imbalance of supply and demand. Nor is it caused by greedy companies raising prices. Higher prices are merely a symptom of inflation.

The money supply in the US has increased by about 6.5% annually since 1960. And US economic output (as measured by real GDP) has risen by an average of about 3%. It’s no coincidence that inflation has averaged 3.5% per year since 1960, i.e. the difference between money supply growth and GDP growth. As long as money supply growth isn’t too much higher than GDP growth, inflation isn’t a problem. And that was the case from the 1970s until the beginning of 2020. But after the COVID-19 pandemic and the response of governments around the world, everything changed. The money supply exploded by 40% in just over two years in the US alone.

Never before in history have we experienced such explosive growth. Not during the Second World War... not during the Vietnam War and the expansion of social programs in the 1960s and 1970s… and not even after the 2008 financial crisis. As long as the money supply, as measured by M2, isn’t reduced, inflation will continue to shake the markets.

Meanwhile, the private equity (PE) industry does not make an exception. PE firms worldwide are sitting on a record number of 28,000 unsold companies. That is a total value of more than $3 trillion combined. The total value of PE-backed companies sold either privately or publicly in 2023 is down 44% from a year ago, the lowest level in a decade. There are simply no buyers in these markets. What will happen next? There will probably be fewer new PE funds as investors need to recoup their invested capital before providing new money. And / or PE firms will have to sell some portfolio companies at a loss. Neither bodes well for the PE sector in the short to medium term.

Perhaps the new global middle class can come to the rescue. 113 million people will enter the global middle class, i.e. consumer class in 2024 alone. Defined by the World Data Lab as someone who spends at least $12 per day (measured in 2017 purchasing power parity), these individuals are typically rising up in developing regions like Asia and Africa. 91 million are coming from Asia with Africa in second position with 10 million people.

The Chinese markets – as measured by the HSI – though were a clear outlier – this time to the upside. The popular “buy India, sell China” stock strategy has reached a tipping point for some investors. Lazard Asset Management, Manulife Investment Management and Candriam Belgium NV are reducing their exposure to India after a record-breaking rally. They are switching to their former favorite, China, as Beijing’s support for its economy triggers a recovery in industrial profits and manufacturing. The emerging turnaround shows that funds are gradually becoming convinced that China’s policy support will be enough to reignite growth. While the big Wall Street banks continue to see India as the top investment destination for the next decade, investors are becoming cautious given the stretched valuations and warnings from regulators about market exuberance.

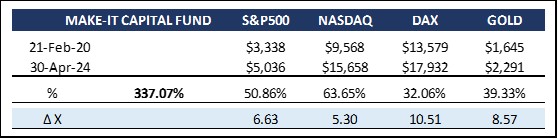

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment.

- The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- The Fund is fully transparent and always trades at the exact NAV.

The Fund has had a difficult month, but has lost significantly less than the entire crypto market, Bitcoin or Ethereum. Our hedging and cash generation strategies were very helpful, but could not prevent a loss for the month.

Although nobody speaks about it, a new accounting standard could have a major impact on future crypto prices. The Financial Accounting Standards Board (FASB) has ruled that companies holding cryptocurrencies must report their value at market value rather than at cost, as was previously the case. This could prompt many companies to invest some of their surplus cash in Bitcoin, for example.

Michael Saylor of MicroStrategy has just published his latest figures. Interestingly, he has chosen not to apply the new accounting standards. Under the old standard, MicroStrategy valued its bitcoin holdings at a quarter-end price of $23,680 apiece, or $5.1 billion, rather than the March closing price of $71,028, or $15.2 billion. The company also announced that it added 122 coins to its bitcoin stack in April, bringing its total holdings to 214,400 coins. This equates to a value of $13.5 billion at the current bitcoin price of about $63,000 (April 30th). CFO Andrew Kang said at the financial press conference that the company intends to fully adopt the new accounting standard for the fair value of digital assets and is currently evaluating the best time to do so. The FASB has stipulated that the new rule must be implemented by January 1, 2025, but early adoption is possible.

Long story short, the new FASB rules represent a huge potential catalyst for the digital assets market. By allowing companies to fully realize the value of their Bitcoin and other crypto holdings, these rules could spark a massive wave of institutional adoption that leads to a more mature mainstream crypto economy. If savvy investors and forward-thinking businesses recognize this potential, we could be on the cusp of a new era of growth and prosperity for the entire cryptocurrency space.

The halving, ETFs, new accounting standards. What is missing is the possibility for banks to custody cryptocurrencies and grant loans against such collateral. On February 14, the American Banking Association (ABA), which represents more than 95% of the assets of the US financial industry, amounting to $13.5 trillion, explicitly demanded that the SEC make changes that would allow banks to hold bitcoin in custody and use it as collateral for loans. Meeting this demand would be – at least according to Michael Saylor – the final piece of the puzzle to get Bitcoin to his target price of $5 million.

Although I consider these price levels to be very far-fetched, one can only surmise that the stars are aligned for higher valuations. Add to this inflationary and geopolitical tensions and it seems that the crypto rocket seems ready to launch any time soon.

Here is Professor emeritus Al Barlett: “The greatest shortcoming of the human race is our inability to understand the exponential function.”

Thank you for your time and attention

Sincerely,

Philipp L.P. von Gottberg