Make-it Capital Edition #40

The World of Cryptocurrencies

| The World of Commodities |

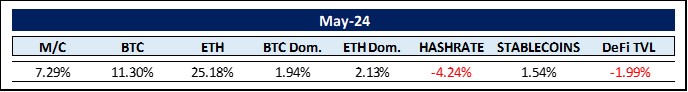

In May, the crypto markets returned to greener pastures gaining $170 billion. The most important factor was the surprising green light for the eight ETH spot ETFs, which catapulted ETH up by 25% within a month – more on this later. Both BTC and ETH were able to extend their respective market dominance.

The U.S. Securities and Exchange Commission (SEC) has remarkably approved the 19b-4 forms for the spot Ethereum ETFs of BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy and Franklin Templeton. While the forms have been approved, ETF issuers must make their S-1 registration statements effective before trading can begin. And that can take up to three months. Still, this was an astonishing move by the SEC that only hardcore believers would have thought possible. After all, Gary Gensler has been sending out Wells Notices to numerous recipients lately (Coinbase, Robinhood, Uniswap, Consensys, etc.). As a reminder, a Wells Notice is a formal communication from the SEC to an individual or company. It informs them that the SEC intends to take enforcement action against them. Essentially, it is a heads-up that regulatory action is imminent. Apparently, a group of bipartisan members of the House of Representatives had urged the SEC to approve the ETFs and put pressure on Gary Gensler to listen to reason and the demands of the market.

DBS, Singapore’s largest bank, is an ether whale, according to on-chain analytics firm Nansen. The blockchain address allegedly owned by DBS held 173,753 ETH worth about $650 million. According to Nansen, the address has made over $200 million from its Ether holdings. In an inflationary environment, holding on to an at times even deflationary asset like ETH makes a lot of sense. I wonder how many financial institutions will follow suit once ETH ETFs start trading for good.

The co-founder of the Chainlink project, Sergey Nazarov, expressed great optimism for Ethereum and all digital assets following the historic approval of the ETH ETFs saying that this is “really just the beginning. Just like many systems and protocols initially list Bitcoin and ETH and then eventually list a multitude of other tokens, that is really the trajectory that we’re on. It is a sign of a very clear trend that not only Bitcoin, not only ETH, but many other tokens out in the world will end up getting their own ETFs at some point, allowing the larger global capital markets to interact with that financial product.” And there is an astonishing demand for these ETFs. Only one BTC ETF, BlackRock‘s iShares Bitcoin ETF, $IBIT, took 8 weeks to reach $15 billion in assets under management. In comparison, the gold ETF, $GLD, took 3 years to reach $15 billion in assets under management.

Speaking of IBIT: Since the Bitcoin ETFs were approved, they have accumulated 240,000 bitcoin, in addition to the 621,000 bitcoin held in the Grayscale Bitcoin Trust when it was converted into an ETF (GBTC). As investors reduced their positions in GBTC, BlackRock’s IBIT overtook GBTC as the largest Bitcoin spot ETF by assets for the first time last week and now holds 290,000 bitcoin vs 286,000 in the GBTC. BlackRock expects sovereign wealth funds and pension funds to increasingly use bitcoin ETFs. The asset manager has helped educate pension funds, endowments and sovereign wealth funds about the new spot bitcoin ETF products, according to Robert Mitchnick, head of digital assets at BlackRock. The firm is seeing a reenforced focus on the issue of allocating to bitcoin and how to think about it from a portfolio construction perspective.

Meanwhile, adding to the demand side, the European Securities and Markets Authority (ESMA), the EU’s financial regulator, is considering whether to allow Bitcoin into the region’s €12 trillion investment fund market. ESMA is seeking feedback on expanding the eligible assets for Undertakings for Collective Investment in Transferable Securities (UCITS). These common retail investment products account for over 75% of the money held by EU citizens. Even if only 1% of the €12 trillion were to flow into Bitcoin, this would be more than double what all US spot ETFs currently hold (862k BTC @ $68k = $58.6bn vs €120bn – $130bn). ESMA is collecting input until August 7 before making recommendations.

The reduction in BTC rewards following the recent halving is starting to make waves. In a recent report, Bernstein analysts Gautam Chhugani and Mahika Sapra expressed the expectation that the US Bitcoin mining industry will consolidate to about five major players that will control significant capacity. Currently, there are more than 20 publicly traded miners. The first move comes from bitcoin miner Riot Platforms Inc ($2.8 billion market cap), which is seeking to take over rival miner Bitfarms Ltd ($845 million market cap) after acquiring a 9.25% stake in the company. “The bitcoin mining business is becoming tougher for smaller players, with limited capital to ramp up on the global hash power race” Off to the M&A races …

Finally, and rather surprisingly, the world’s leading stablecoin (USDT) issuer Tether invested $200 million and acquired a majority stake in Blackrock Neurotech via its newly founded venture division Tether Evo. Paolo Ardoino, CEO of Tether, says: “Tether has long believed in nurturing emerging technologies that have transformative capabilities, and the Brain-Computer-Interfaces of Blackrock Neurotech have the potential to open new realms of communication, rehabilitation and cognitive enhancement.” It appears that Tether is expanding its universe into tech venture capital.

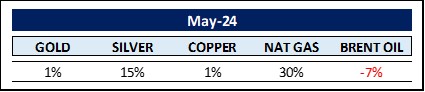

Silver is up a remarkable 26% since the start of the year, hitting an 11-year high, with demand generally coming from industry – half of silver is used in industrial processing and technology. There is some demand for silver as a safe haven, but industrial demand has driven the price up thanks to robust manufacturing activity. It is an important material for solar panels, which are being manufactured on a large scale in China as part of the transition to sustainable energy. As per a January report by the Silver Institute, global silver demand is expected to exceed supply for the fourth consecutive year in 2024.

According to Guan Tao, global chief economist at BOC International, in the past when China increased its gold holdings, it bought domestically with yuan. But this time, Guan Tao said, the central bank is buying gold in US dollars, — reducing its exposure to the American currency. Many central banks, including China, began buying gold after the US Treasury took the rare step of freezing Russia’s dollar holdings as part of sanctions imposed on Moscow. Guan said the sanctions had shaken the “foundation of trust for the current international monetary system” and forced central banks to protect their reserves with more diverse holdings. “We can see this wave of gold’s rise may be different from the past,” he said. Although Beijing has been buying gold, the metal accounts for only about 4.6% of China’s foreign exchange reserves. In percentage terms, India holds almost twice as much of its reserves in gold…

Platinum consumption is set to outstrip supply by the largest margin in 10 years as demand for the precious metal used in catalytic converters remains strong. According to a Johnson Matthey report on platinum group metals, the deficit this year is expected to be more than half a million ounces. At the same time, primary platinum supply is forecast to decline as Russian supplies return to more normal levels following the massive sale of mined stockpiles in 2023. The platinum price has been trading at a discount to the gold price since 2015. The metal’s rarity value and its appeal as a precious metal for jewelry are overshadowed by declining industrial demand and the assumption that electric vehicles will quickly become the predominant form of transportation. This is not happening nearly as quickly as many expected. Platinum is up 8% for the month.

A sudden increase in LNG exports led to a shortage of domestic supply and put upward pressure on prices. US natural gas futures hit a 14-week high on forecasts for rising demand over the short term and a continued decline in production output. The International Energy Agency (IEA) assumes that the global electricity demand of data centers could exceed 1,000 terawatt hours by 2026, which corresponds to a doubling of the 2022 level and the entire electricity demand of Germany. The Energy Information Administration (EIA) assumes that 20 new natural gas-fired power plants will go into operation in the United States between 2024 and 2025. These plants will have a total capacity of 7.7 gigawatts and will drastically increase local demand.

Among the most important commodities, cocoa is still the strongest with a year-on-year gain of 209%, while lithium still holds the red lantern at the other end of the spectrum with an annual loss of 65%.

The Rest …

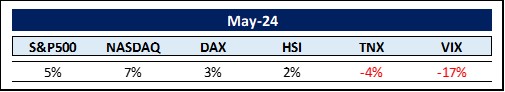

The global stock markets continued their upward trend, once again led by the companies with the highest market capitalization on the NASDAQ. The dominance of these companies is astounding. By market cap, here are the most valuable assets/companies:

1. Gold ($15.76T)

2. Microsoft ($3.08T)

3. Apple ($2.95T)

4. NVIDIA ($2.70T)

5. Alphabet (Google) ($2.14T)

6. Saudi Aramco ($1.87T)

7. Amazon ($1.84T)

8. Silver ($1.72T)

9. Bitcoin ($1.33T)

10. Meta Platforms (Facebook) ($1.18)

Interestingly, this list is dominated by commodities, US-based AI-hardware related super caps – and Bitcoin.

The gap between the price/earnings ratios of US small caps and large caps is wider than it has been since 1999… and after the dotcom crash, small caps outperformed large caps over the next ten years. Perhaps the light of small caps is starting to shine brighter again. Tom Lee, former chief equity strategist at JPMorgan and co-founder of Fundstrat Global Advisors, certainly thinks so as he believes that inflation is now under control, and since small caps have been the hardest hit by high borrowing costs, the expected change in monetary policy should be a boon for these assets. In his opinion, small caps should rise by 50% in 2024.

In any case, Michael Wilson, a prominent Wall Street strategist at Morgan Stanley, has recently undergone a significant change in his outlook. After years of taking a pessimistic stance, he is now optimistic about US equities. In his bullish scenario, the stock market could rise by a further 20 % and take the S&P 500 to 6,350 points. He expects robust corporate earnings to drive equity growth. While Wilson is now among the bulls, JPMorgan’s Dubravko Lakos-Bujas and Marko Kolanovic are among the few remaining bears on Wall Street. JPMorgan is sticking to a year-end price target of 4,200 for the S&P 500, which represents a potential downside of 21% from current levels. Interesting.

Bond traders are the smartest people on the trading floor – at least that’s the old saying on Wall Street. The bond market generally reacts more quickly to economic developments – such as higher or lower inflation – than the stock market. Bonds are more focused on the future macroeconomic situation, whereas the stock market can be driven by emotions and positioning. Simply put, both stocks and bonds are good at discounting future economic developments, but bonds tend to be ahead of the game. A divergence between bonds and equities has been emerging since the beginning of the year, which could be the harbinger of a market reversal to the downside. So far this year, investors have acted as if inflation has peaked. Most want to believe that the Fed will hold interest rates steady – or cut them – in the months ahead. But what if investors are wrong about this bet? As investors, we need to monitor this situation very closely and not blindly fall into another market mania, be it through BTC or ETH ETFs or simply through AI-induced fantasies. Then again, the broad market shows signs of health as the Advance/Decline line is rising. Anyhow, the picture is murky. Caveat emptor. A Chinese proverb comes to mind: “Enjoy yourself. It is later than you think.”

Closing we need to address the US treasury market. In the last seven months, China has sold US government treasuries worth $74 billion. This move is part of a strategy to distance itself from the US economy. As already addressed above, the country is accumulating gold instead. According to the People’s Bank of China (PBOC), the country now owns 2,250 tons of gold worth almost $170 billion, although no one knows the exact figure. Some analysts, such as Jan Nieuwenhuijs of Gainesville Coins, estimate that China has covertly accumulated more than double the official figure, which is the main reason for the recent steep rise in the price of gold. This change in reserve strategy is in line with the BRICS agenda of de-dollarization, aiming to knock the US dollar off its throne. Whether the US dollar will lose its status as the world’s reserve currency remains to be seen. One way out could be stablecoins that are backed by the US dollars, such as USDT and USDC. Even in an unregulated market environment, stablecoins cumulatively already reach the equivalent of $160 billion. These stablecoins not only swallow US government bonds that other countries sell, but if fully regulated, could become the new currency of choice for international trade, strengthening the position of the US dollar.

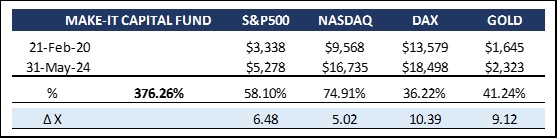

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment.

- The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- The Fund is fully transparent and always trades at the exact NAV.

The Fund had another great green month more than making up for last month’s losses. Our cash generating pillar no. 3 did not perform as well as in previous months due to external factors. We expect this to change for the better in June.

Encouragingly, venture capital activity in the crypto and blockchain space is clearly picking up again, pointing to rising demand for cryptocurrencies in general. After three consecutive quarters of decline, investors invested $ 2.49 billion in 603 deals in the first quarter of 2024, according to data compiled by Galaxy Research, representing a 29% increase in funding and a 68% increase in the number of deals compared to the previous quarter.

In a fairly obvious case of political opportunism, Donald Trump recently endorsed cryptocurrencies wholeheartedly. Remember back in 2021 when he warned in an exclusive interview on Varney & Co. that investing in cryptocurrencies was “potentially a disaster waiting to happen” He clarified that he was “not a big fan” of digital currencies, including Bitcoin, and did not personally invest in them.

Now, he stated that he is “very open-minded” about cryptocurrency companies and everything to do with this burgeoning industry. Trump emphasized that the United States must be a leader in this field and leave no room for second place. Obviously, 50.3 million crypto holders in the US represent a very significant constituency. He also said he would guarantee the right to self-custody, which I believe is at the heart of our future financial freedom. Also note his promise to never make a central bank digital currency (cbdc) a reality in the US.

Meanwhile addressing the Demoract camp, Hayden Adams, founder and CEO of decentralized crypto exchange Uniswap, said the Biden campaign and its strategists are misjudging the importance of cryptocurrencies in the November elections. He argued that, on the contrary, the Trump campaign and other Republicans “smell blood in the water” and are already “turning hard towards crypto.”

Now things seem to start moving. Although they still support Gary Gensler and the SEC’s regulatory approach to cryptocurrencies, those potential 50.3 million voters just seem too appealing to pass up. U.S. President Joe Biden‘s re-election campaign team has begun reaching out to key figures and entities in the cryptocurrency industry to get recommendations from digital asset players about “the crypto community and crypto policy moving forward,” The Block reported recently, citing sources with direct knowledge of the matter who spoke on condition of anonymity. Several sources said the latest development, which began about two weeks ago, signals a significant “shift” from the Biden administration’s previous dealings with the industry. At least the Biden camp is apparently beginning to get properly informed. The first step in overcoming prejudice.

Here is Socrates: “There is only one good, knowledge, and one evil, ignorance”

Thank you for your time and attention

Sincerely,

Philipp L.P. von Gottberg