| THE WORLD AS WE SAW IT IN MARCH 2024 |

| The World of Cryptocurrencies |

| The World of Commodities |

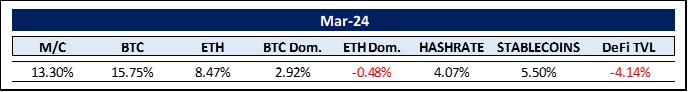

The bull continues to charge, even if it encounters more volatile fluctuations. Bitcoin, for example, recorded a maximum drawdown of 15.25%. Nevertheless, the total market capitalization increased by $315 billion, with bitcoin leading the way increasing its market dominance to 51.9%. The Bitcoin network has never been as strong and secure as it is today, which is reflected in a new all-time high hashrate. DeFi total-value-locked could not keep up and lagged behind the overall market.

Nearly $900 million was withdrawn from BTC ETFs mid-month, driven by continued outflows from the Grayscale Bitcoin Trust (-87,011 BTC for the month and -285,776 BTC since January 10th) as well as a mid-month decline in subscriptions to offerings from BlackRock Inc. and Fidelity Investment. The group of 10 ETFs experienced one of the worst weeks of the year since the launch of the BTC ETFs in January. This is also the reason for the increased volatility mentioned above. In total, however, the 10 ETFs collected around 65,000 BTC in the month of March and now hold collectively roughly 835,000 BTC currently worth about $58.5 billion.

“Although ETF inflows have slowed, order books on the money side are full around the 60k range, which shows the market is eager to buy the dip,” said Nathanaël Cohen, co-founder of digital asset hedge fund INDIGO Fund. And that is exactly what happened. Bitcoin broke through the very short-term sequence of lower rally highs. This is a clear upward momentum and indicates that the short-term outlook is for a retest of the highs and possibly an upward breakout.

With the halving expected for April 20th, I wouldn’t bet against Bitcoin.

As an interesting sidenote, the U.S. recovered more than $900 million worth of Bitcoin from the wallets of hackers who attacked the crypto exchange Bitfinex in 2016 and syphoned off 119,000 BTC. This transfer increased the federal government’s reserve to just under 200,000 BTC. That’s worth around $14 billion at today’s prices.

So you would think that it would be in the best interest of the US government to thwart the SEC’s Genslering. Well, you could say that Gary Gensler is not attacking Bitcoin directly, but merely smart contract products like Ethereum and Solana, which he calls securities. Yet he has explicitly said that Bitcoin is not a security. On the other hand, if the US owns about 200,000 Bitcoin, one could assume that they have also seized significant amounts of Ethereum and Solana. Furthermore, the SEC’s stance seems to be only focused on getting certain cryptocurrencies under its umbrella, which is completely counterproductive as it harms the entire crypto market. It’s time for Gary to get back to his competencies instead of doing everything he can to increase the SEC’s power and sphere of influence.

There are other areas that need more attention such as crypto hacks. A recent report by Decrypt, a media company specializing in crypto, has revealed the five biggest crypto hacks and exploits in 2023 in terms of the number of losses. The cyberattack on the Mixin network ranks first on the list with stolen funds amounting to $200 million. The Mixin network hack was followed by attacks on the DeFi protocol Euler Finance, the crypto exchange Poloniex, the crypto wallet solution Atomic and the DeFi platform Curve Finance. The five largest attacks resulted in a total loss of 683 million dollars.

Data compiled by TRM Labs indicated that hackers stole a total of 1.85 billion dollars in cryptocurrencies in 2023 This figure represents a 53% decrease from the $4 billion in cryptocurrencies lost to hacks and exploits in 2022.

It’s good that the number of crimes has fallen significantly, but it needs to be reduced much more. Unfortunately, we’ll never overcome the criminal mind of certain people, but AI will find bugs and loopholes in code faster and faster, and so we should be able to continually reduce these malicious exploits before a hacker can take advantage of them. I’m glad that the Make-It Fund has never fallen victim to an exploit, hack or even a rugpull.

The World of Commodities

Gold and silver clearly had a spectacular month, with gold reaching a new ATH. As silver slightly outperformed gold, the gold-silver ratio fell slightly and currently stands at 88. Natural gas continues its slide and is now down 29% in 2024. In contrast, Brent oil is on the upswing again increasing 11.6% in the first three months.

Gold mining stocks are valued at steep discounts to the current gold price, which might set the group up for a sharp reversion to the mean. With the underperformance of gold stocks relative to the gold price at a historic low, it might be a good idea to think about both the reasons for the underperformance and a potential catalyst for a recovery.

Prices for two of the world’s most important mining commodities are rapidly diverging: copper is rising to over $9,000 per ton as supply cuts weigh on the market, while iron ore is falling in the face of demand headwinds. Hesitantly, traders are also warming to the idea that the worst of a global downturn is a thing of the past, especially for metals like copper that are increasingly used in electric vehicles and renewable energy. However, signs of the headwinds in traditional industrial sectors remain clear in the iron ore market, where futures fell below $100 a ton for the first time in seven months on Friday. Investors are betting that the years-long real estate crisis in China will continue until 2024 and dampen demand. China has more steel production capacity than the rest of the world combined. If the pace of housing construction and other infrastructure projects does not recover, this will mean a significant setback for iron ore producers’ demand growth forecasts.

In the broader commodity world, cocoa continued to soar by a further 51%, reaching a staggering 239% year-on-year increase. This year’s chocolate Easter eggs had better be replaced by something else sweet. Also worth noting is the 13% fall in the price of uranium in March. Nevertheless, it still rose by 77% year-on-year with demand on the upswing due to a lot of new fission reactors being built worldwide.

| The Rest … |

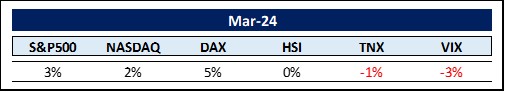

Stock markets continue their upward march. Of the stock markets that we observe, the German DAX has taken the lead with an increase of 10.4% year-to-date. The 10/2 year Yield Curve remains inverted and has not moved much for the year. Volatility measured by the CBOE VIX is down 30% year-on-year.

Let’s talk about the Bank Term Funding Program (BTFP) because it is an important topic: The Federal Reserve initiated the most aggressive series of rate hikes in history by raising the Fed Funds Rate from just 25 basis points in March 2022 to 550 basis points by the end of August 2023.

As we know, this caused low-yielding government bonds to lose significant value, leading to the third and fourth largest bank failures in US history (Silicon Valley Bank and Signature Bank) with a combined $420 billion in assets).

Following these modern-day bank runs, it was feared that all banks, large and small, would dump their undervalued government bonds, leading to a global financial crisis. Therefore, the Federal Reserve rushed to launch a newly constructed Bank Term Funding Program (BTFP) on March 12, 2023, providing liquidity to the entire banking sector and accepting Treasury bonds as collateral at par value, i.e. well above their actual value at that time. To make this program possible, the U.S. Treasury Department backed the program with $25 billion, which was considered the absolute maximum amount that could be drawn under the program. In fact, BTFP loans peaked at $167 billion in January of this year and still stand at $164 billion.

Now, the Federal Reserve ended BTFP lending on March 11, and all loans must be repaid within the next 12 months. The problem with this is that the Fed Funds rate is still at 5.50 basis points, so the government bonds that the banks have put up as collateral are still well underwater. For New York Community Bank (which acquired Signature Bank), this already appears to be too much as its share price has plummeted from $14.22 to $3.22. With BTFP lending halted and massive loans to be repaid, many banks will not be able to repay the funds. Many will be classified as insolvent, triggering another wave of bank consolidation.

The 2nd richest man on the planet, Jeff Bezos ($199bn) sold 50 million Amazon shares: $8.5bn. He still owns 10% of Amazon though which has a market cap of $1.87tn. The 4th richest person on earth Meta’s Mark Zuckerberg ($176bn) sold stock worth $500 million. And finally, Jamie Dimon (J.P. Morgan) (net worth $2.1bn) wants to sell $150 million worth of stock for the first time ever.

Do they know something we don’t?

This is also rather frightening:

“Q-Day” is the term some experts use to describe when large quantum computers will be able to factorize the large prime numbers that underlie our public encryption systems, such as those designed to protect our bank accounts, financial markets, and key infrastructure. Experts expect this to happen as soon as 2025. Apple are postquantum-proofing their tech suggesting the Q-Day is around the corner.

Turning attention to CBDCs (Central Bank Digital Currencies) . There are currently more than 100 countries exploring the use of CBDCs and those countries represent more than 95% of global GDP.

All paper currencies will be phased out, starting with all 50 dollar bills and above (or the foreign equivalent), then the 20 dollar bill, until only 1, 5 and (perhaps) 10 dollar bills remain. This is what the Thomas D. Cabot Professor of Public Policy and professor of economics at Harvard University Kenneth Rogoff proposes in his book: The Curse of Cash. In the ideal world for Rogoff and financial elites like him, governments will monitor ALL cash transactions.

A pioneering computer scientist named Paul Armer sounded the alarm back in the 1970s. Armer headed the computer science departments of the RAND Corporation think tank and Stanford University in the 1950s and 1960s. In June 1975, he issued a frightening warning about what would happen to our privacy if governments abolished physical cash and switched to a purely digital system. In a lecture at Stanford University entitled “Computer Technology and Surveillance“, he warned that such a system would become a powerful surveillance tool for the state.

Armer compared what would happen to Nineteen Eighty-Four… In George Orwell’s novel, a totalitarian superstate rules over a world in which individualism and independent thought are punished as “Thoughtcrimes.” Privacy and freedom are forbidden. The state controls the lives of its citizens through omnipresent surveillance.

Crypto to the rescue …

We’ve got to talk about US and global debt again: The US debt mountain has grown even larger post-COVID, as the economy ran huge deficits of more than 6-7% of GDP. Economists commonly use a metric known as the marginal productivity of debt to understand how debt issuance affects economic growth. For every dollar issued in debt, the corresponding increase in GDP is calculated. Surprise, surprise: In the fourth quarter of last year, the US government’s debt pile grew by more than $880 billion while GDP only increased by $329 billion. This shows that productivity is going down the drain as more debt than ever is needed to generate a single dollar of GDP growth.

By the way, global debt has increased by $15 trillion last year and has now reached a new record high of $313 trillion or about 330% of global GDP. I am not saying that the world will end tomorrow. We just need to be aware of the circumstances we find ourselves in. On a positive note, we have just entered the second half of the 18.6-year real estate cycle, which historically indicates a continuing bull market at least until around 2026.

Standing for a new way of politics, the libertarian President of the Argentine Nation, Javier Milei is certainly having a positive effect on the local stock market, the Merval, which has risen by 21.49% this month. He has also significantly reduced inflation, even if it is still very high at over 13.2% down from 25.5% in December when he took office. These are monthly figures mind you. By contrast, the worst performing stock market was the Icelandic one, where the ICEX fell by 7% for the month. However, Icelandic inflation stands at 6.6% annually.

Finally, I am sorry, but I have to leave you with another frightening number: According to research firm GWI, social media represents more than 38% of online time among global users ages 16 to 64. On average, Americans spend roughly two and a half hours on social media every day. That number is closer to six hours per day spent on social media among American teens.

Here is Albert Einstein: “Only two things are infinite, the universe and human stupidity, and I’m not sure about the former.”

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment.

- The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- The Fund is fully transparent and always trades at the exact NAV.

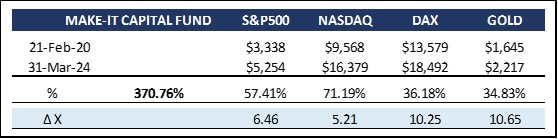

The Fund was close to reaching an all-time-high on March 16th only to retreat by 6% in line with its two main positions Bitcoin and Ethereum. Solana keeps forging ahead and Make-It pillar #3, market making and arbitrage, is continuing to produce outstanding results.

It was interesting (to say the least) to see that BlackRock, the world’s largest asset manager, has taken significant steps towards asset tokenization in partnership with Securitize Markets, LLC. As such BlackRock unveiled its first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), which is issued on the Ethereum network. BUIDL invests 100% of its total assets in cash, US treasury bills and repurchase agreements, with investors earning returns while holding the token on the blockchain. again, BlackRock is leading the way, and we are sure many traditional asset managers will follow in their footsteps. According to a recent report by McKinsey the market for tokenized digital securities will reach a total of $4-5 trillion by 2030.

It is amazing to warp your head around the fact that we are still only in the first few innings of blockchain adoption.

In issue #37, we drew your attention to the powerful AI x Crypto symbiosis, and we are still fascinated by the sheer endless possibilities. This is an area we are watching very closely. If you want to delve deeper, below is a secure link to a paper by University of Oxford students Mohammed Baioumy and Alex Cheema. From page 74 to page 131, they list all the relevant AI x Crypto projects that they know about. The first projects that are likely to catch on are AI agents or, as the authors call them, information agents. It’s no wonder Google/Alphabet is trying so hard to jump on the LLM/AI bandwagon as they have already lost quite a bit of their 90% market share in internet search since the release of ChatGPT.

The software world as we know it is going to change radically in just 5 years, and we see amazing investment opportunities emerging.

Thank you for your time and attention

Sincerely,

Philipp L.P. von Gottberg

Here is the promised link to the AI x Crypto report mentioned above: