June 01, 2023

THE WORLD AS WE SAW IT IN MAY 2023

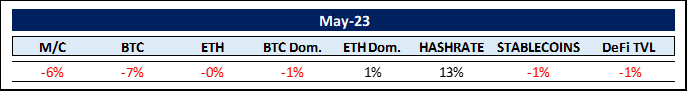

The World of Cryptocurrencies

Ethereum (ETH) has become deflationary since The Merge, at -0.314% per year. And Bitcoin (BTC) is experiencing increasing adoption via the Lightning Network, benefiting from the introduction of Ordinals and the US banking crisis as general confidence in the banking system wanes. Still, their price movements do not reflect much excitement.

ETH caught up with BTC and regained 1.4% of BTC’s market dominance. The Hashrate shot up another 13% and reached an ATH (all-time high). This is good news because the higher the hashrate, the higher the difficulty, the more secure the Bitcoin network.

Both Stablecoins and DeFi TVL (Decentralised Finance Total-Value Locked) lost less in percentage terms than the total crypto market capitalization, which is telling.

Speaking of stablecoins, the world’s largest stablecoin issuer, Tether (USDT), has submitted its latest independent audit by BDO Italia. The results are startling. While BlackRock, the world’s largest asset manager with $9 trillion in assets under management (AUM), posted a net profit of $1.15 billion in the first quarter of 2023, Tether came in at $1.48 billion for the same period. And that’s with a market cap equivalent to 0.9% of BlackRock’s AUM. Tether generates revenue by charging fees – by minting USDT – but the bulk of its profits come from $53 billion in collateral parked in Treasury bills, which earn a yield of nearly 5%. With its 60 employees, Tether generated net income of $24.67 million per employee in the first quarter.

Tether then increased its BTC holdings and currently holds the equivalent of $1.5 billion in BTC. It also decided to allocate up to 15% of future net realized operating profits to accumulate even more BTC diversifying its reserves.

Despite all the arduous haggling by various U.S. institutions, the development and adoption of cryptocurrencies continues unabated.

According to the 2023 State of the Crypto Report by Andreesen Horowitz (a16z), Web.3 gaming is accelerating with 717 new games in 2022. Incredibly, consumers also spent an estimated $67.9 billion on digital in-game purchases last year. Gaming profits are outpacing almost every other industry, and blockchain technology can and will catapult gaming into a new stratosphere.

In terms of adoption, we have seen an interesting development in Europe. Deutsche WertpapierService Bank AG (dwpbank), a German securities settlement giant that manages over 5.3 million securities accounts, has announced the launch of its new platform, wpNex, which will allow over 1,200 affiliated banks to offer BTC trading to their retail customers. Together with the launch of MiCA (more on this below), this opens a lot of new doors for cryptocurrencies in Europe.

Hong Kong is refreshing its image and slowly but surely becoming a center for digital assets. A first step was taken by officially defining digital assets. As such, they have been classified as property rather than securities (SEC) or commodities (CFTC). This is leading to secondary effects that will eventually allow many companies to operate with much-needed regulatory clarity. More on the Chinese crypto revival below.

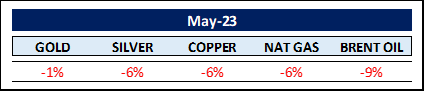

The World of Commodities

May 2023 was a month to forget for commodities. Commodity prices fell sharply driven by a triple whammy of 1.) recession fears, 2.) still persistent inflation, and 3.) Chinese bear seemingly going back into hibernation.

The only commodity that increased was lithium (+67%), although it still declined by -36% year-on-year.

Supply is tight though. Chairman & CEO of the Duquesne Family Office, Stanley Druckenmiller, said in a recent interview: “Copper is in the tightest position I have ever seen it, (..however..) I am actually afraid to have a meaningful position in it facing a hard landing.”

Base metals demand is strongly linked to Chinese imports. However, recent data suggest that Chinese M2 money supply has contracted after the initial reopening surge and the corresponding Credit Impulse appears to have peaked. Chinese credit impulse is a well-known indicator for industrial commodities and crude oil, and a decline in credit impulse suggests falling commodity prices.

Plus, in contrast to the monetary problems facing the West, China appears to be on the verge of deflation, as the Chinese CPI (consumer price index) has fallen to 0.1% and its PPI (producer price index) is deep in negative territory.

It appears that there are still some particularly heavy lids on commodity prices in the near term.

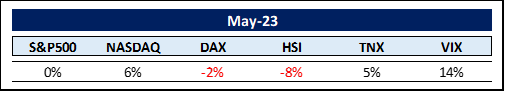

The Rest …

The NASDAQ is up an amazing 24% this year. Are we back in good times? When you look under the hood, you see that this performance is based on a few large companies that are best summed up by the humorous acronym MANTAMAN (Microsoft, Apple, Netflix, Tesla, Amazon, Meta, Alphabet & NVIDIA). These companies account for about 30% of the NASDAQ market capitalization, but have caused almost all of the recent rise. Meanwhile, small and mid-cap stocks are essentially unchanged.

The cover of this Make-It Capital Edition #31 was chosen to reflect the sudden importance of AI (Artificial Intelligence) in our daily lives. AI, or more specifically, the exponential advancements in natural language processing and generative AI, have driven most of the journey to MANTAMAN’s meteoric resurgence in 2023.

A little perspective is useful as the world struggles to grasp the implications. What is AI? So far, AI is simply a pattern recognition algorithm that can produce understandable results and interactions. Aptly, the term “autonomic intelligence” was recently coined. Only through human input can such autonomic intelligence exist, respond, and produce results. Without such input, it has no active, self-directed state. Still, this appears to be only the first iteration. Where this will lead is uncertain. What is no longer in question is its seminal impact on almost everything we do. Exciting and highly dangerous at the same time.

Speaking of danger, the most important question affecting the short-to-mid-term development of the markets is whether we are threatened by a new credit crisis.

Economies need more money to grow. New money creation boosts spending, production, and economic activity in general. But the opposite is also true. When credit growth turns negative, the money supply shrinks, and the economy goes with it.

Most of the new money enters the economy through bank lending. Banks raise the money for lending from customers’ deposits. When depositors’ money leaves the banking system because it is better off elsewhere (money markets, even the Apple/Goldman Sachs‘ offering), banks have no more funds to lend. This disparity is causing new money supply, as measured by M2, to shrink as much as it last did during the 2007-2008 GFC (Global Financial Crisis). Edward Hyman of Evercore even called the current situation the “biggest shrinkage in money supply in history.”

To the rescue comes the BTFP (Bank Term Funding Program). Contrary to what many believe, however, the BTFP does not flush new liquidity into the market. It simply allows banks to return money to depositors. This is a key point of subtle but important difference. Its sole purpose is to prevent a run on the banks and a complete collapse of the banking system.

This leads to negative growth in credit and money supply. And when that happens, unfortunately, markets often react negatively.

Markets breathe liquidity, and if oxygen masks as a last resort are out, be careful. J.P. Morgan comes to mind: “Liquidity is like a cab in New York on a rainy night. It disappears when you need it most”.

This smoldering scenario should remind us to remain vigilant and not get sucked into a misleading, promising investor world, as suggested by the rise of the NASDAQ in 2023.

One should also be aware that the rather benign CPI figures may be deceptive, because if one were to apply the 1980s inflation formula, CPI would have risen 13%, not 4.9%. The interest rate storm may not be over yet.

Caveat emptor.

In closing, we must address, albeit briefly, the farce of the debt ceiling debate. Since 1960, Congress has raised, extended, or revised the debt ceiling 78 times, 49 times under Republican rule and 29 times under Democratic presidents. Will it be different this time? You decide.

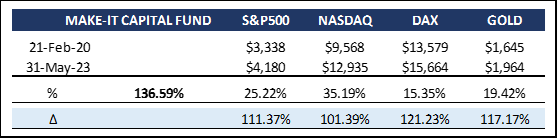

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger/crypto assets with just one investment.

- The Fund is set out to reduce inherent risk and volatility by employing its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- It is open to institutional and accredited investors worldwide.

- Open-end structure with a minimum investment of $50,000.

- The Fund is fully transparent and always trades at exactly NAV.

The Fund continues to outshine its market benchmarks. We increased our trading activity in May, benefiting from a fairly volatile market. In general, we continue to believe that we have entered another bull phase that will last until the first or second quarter of 2015.

A lot of disturbing noise is being produced, especially by certain U.S. authorities, but this seems to be a calculated move.

It appears that the U.S. is following China’s lead to launching a digital currency to its populace. To increase public acceptance of the digital dollar, competition is being suppressed. By limiting the competitiveness of alternatives – i.e., other digital currencies – through onerous regulations and lack of transparency, U.S. authorities are endeavoring to pave the way for maximizing the acceptance of the digital dollar. The first step on the road to embedding the digital dollar in society is imminent with the launch of FedNow this July. It does not seem far-fetched to assume that the Fed’s goal is to solidify its role with respect to the digital dollar, establish a framework for widespread adoption, and then relax destabilization efforts of competing cryptocurrencies – much along the lines of China. Fascinatingly, we can see this happening live in China right now, where a new crypto hub is being built in Hong Kong that will allow crypto trading to resume on as soon as June 1 (today).

This bodes well for digital markets in general. However, regulation in some form is urgently needed. Surprisingly, the EU (European Union) has come up with an initial set of regulations dubbed MiCA (Markets in Crypto Assets) that even seems to make some sense and be workable. In it, MiCA defines a crypto asset as a “digital representation of a value or right that can be transferred and stored electronically, using distributed ledger or similar technologies.” This encompasses almost all cryptocurrencies, including Bitcoin and Ethereum, and overcomes the never-ending, misleading, and at the same time harmful power games being played in the US. May we suggest copy, paste, and run?

We are often asked what to own, gold or bitcoin? Personally, we hold both. From the beginning, we have advised holding between 1-5% of assets in cryptocurrencies, because even gold is not infallible.

It seems no coincidence that Bitcoin’s founder, the probably fictional Satoshi Nakamoto, chose to have his birthday on April 5 – the date the US made gold ownership illegal through EO 6102 on April 5, 1933. He then chose 1975 as his birth year, which coincides with the year US citizens were allowed to own gold again.

Warren Buffett shared this: “Someone is sitting in the shade today because someone planted a tree a long time ago.” Maybe investing a little in select cryptocurrencies is like planting a few trees today…

Thank you for your time and attention.

Sincerely,

Philipp L. P. von Gottberg

PS – should you feel inclined, here is a direct link to the above mentioned State of Crypto Report by a16z:

https://a16zcrypto.com/posts/article/state-of-crypto-report-2023/