April 03, 2023

THE WORLD AS WE SAW IT IN MARCH 2023

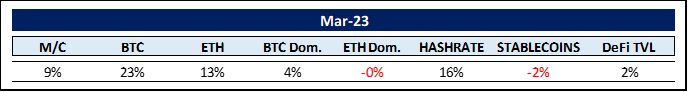

The World of Cryptocurrencies

BTC (Bitcoin) had an amazing first quarter 2023 rising 72% as millions of citizens suddenly realized that their bank deposits were partly unsecured loans to the traditional financial industry. Seeking shelter and security for their monetary assets, US investors, additionally pushed by major pro-crypto moves by Wall Street (Fidelity, BNY Mellon, Nasdaq – to name but a few), poured into BTC accounting for 47% of its recent move.

Concurrently BTC also increased its market dominance to 46% in what some pundits called “BTC’s milkshake moment” leaning on the Dollar Milkshake Theory put forward by Brent Johnson, CEO of Santiago Capital. The entire market capitalization expanded by close to US$ 100 billion month-over-month. As good as this sounds, the market still is down -44% or some US$ 900 billion from 12 months ago.

The US-led assault on stablecoins, in particular USDC and BUSD resulted in monthly losses of -23% and -28%, respectively – or US$ 13 billion in total. US$ 9 billion of those were picked up by USDT keeping the overall loss for stablecoins relative to total market capitalization rather moderate at -2%.

After having banned crypto about five times before, it is common knowledge that in 2021 the Chinese were at it again. This time China not only forbade owning and trading crypto but went so far as to destroy its very own – at that time world-dominating – crypto mining industry (65% market share). All of this was pursued to terraform the ground for the introduction of its digital currency, the e-Yuan.

As per August 31, 2022, the e-Yuan reached the threshold of transactions surpassing 100 billion Yuan equivalent (US$ 14 billion). We can surmise that adoption rates have not dropped since – to the contrary. China now seems satisfied that its cbdc (central bank digital currency) has reached critical mass as it is now also integrated into the all-in app WeChat providing 1 billion people actionable access to the e-Yuan.

Having achieved their primary goal, Chinese authorities recently set in motion a 180 degree crypto U-turn allowing its special administrative region Hong Kong to develop a bespoke crypto hub. China also introduced a centralized marketplace for NFTs and other digital assets in December 2022. Both moves took the entire crypto industry by surprise.

Now, here is the crucial question: Are the US following the Chinese playbook?

It certainly appears so. In a Shiva-like move leading to the closure of its two most important fiat gateways (Silvergate & Signature and not even mentioning SVB here), US regulators shut down the US crypto industry’s access to the ACH network (Automated Clearing House) in what has been termed Operation Choke Point 2.0. Moreover, apart from launching their above mentioned attack on stablecoins and shutting down fiat on-and-off ramps, US authorities opened a third front by suing and/or subpoenaing some of the most prominent crypto exchanges.

To illustrate the random character of the exchange attacks, CTO Larsson simplified a convoluted situation like this: The CTFC (Commodities Futures Trading Commission) sued the world’s largest exchange, Binance, because ETH (Ethereum) was a commodity, while regulated exchange Kraken, was sued by the SEC (US Securities and Exchange Commission) because ETH was a security. Interesting.

All this in light of the planned introduction of FedNow (the centralized instant-payment service by the US Federal Reserve Banks) planned for July 2023 – followed by the introduction of a digital US-Dollar in the not too distant future.

So, are the US stepping in China’s recent footsteps?

Yes, they are. Using different means, however, attaining the same goal. Destroying private competition until its own product has been forced onto the market.

And this gives me hope. It seems once the digital US Dollar has been irreversibly flushed into the system, the US stance toward the crypto industry might soften and experience a Chinese-style U-turn. After all, there are US elections in 2024, and some 40 million 18-35 year old voters own crypto. And this electorate currently is rather disgruntled to say the least.

Moreover, the Washington D.C. law firm Cooper & Kirk after having successfully sued the FDIC, Federal Reserve, and OCC over the original Operation Choke Point, is at it again. In the words of lawyer David Thompson: “Even though the first Operation Choke Point was exposed and brought to a halt, we always feared that the regulatory tools that had been wielded against payday lenders and tobacco shops would be picked up again in the future and used against the next politically unpopular industry,” And, “It looks like that time has come, and crypto is now the industry with a target on its back. Congress must once again hold the federal banking regulators to account and ensure that this Operation Choke Point 2.0 is exposed and brought to an immediate halt, just like version 1.0.”

So, all is not doom and gloom. There clearly are several lights at the end of this toxic tunnel. If in the end, we have created a fairer, more accessible and equitable financial system, all hardship has been worth it and perhaps even essential.

As German philosopher Georg W. F. Hegel (1770-1831) put it: “The length of the journey has to be borne with, for every moment is necessary.”

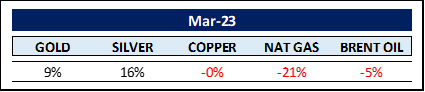

The World of Commodities

J. P. Morgan stated about 100 years ago. “Gold is money. Everything else is credit.” And in the words of the American banker and author, Charles R. Morris, “Credit is the air that financial markets breathe, and when the air is poisoned, there’s no place to hide.“

In light of the above and amid the biggest banking and credit crisis in the last 50 years, Gold had its best month since July 2020 rising 9%. As we observed last month, the GSR (Gold/Silver Ratio) had hit an extreme and unsustainable level at 92, resulting in Silver playing catch-up gaining a massive 16% in March thus reducing the GSR back down to 82.

Natural Gas prices continued their slide, now down 51% in 2023. Fears of a global recession impacted oil prices to the downside – leading OPEC+ to a surprise 1.16 million bpd (barrels per day) cut in production. On the other hand, the IEA (International Energy Agency) forecasts oil demand to rise to 101.7 million bdp in 2023. That would be the highest on record. In view of these predictions – less supply and more demand, it does not take rocket science to assume higher oil prices in the not too distant future, despite Goldman Sachs expecting the opposite citing an uncertain economic climate. I beg to differ.

Again, fearing a global recession and consequently diminishing demand for electric vehicles, Lithium Carbonate prices in China kept tumbling, having now declined 55% for the year reaching the lowest price point in 15 months. And finally, on the winning side, impacting breakfasts around the world, this months biggest commodity gainers were eggs (+37%) and tea (+25%).

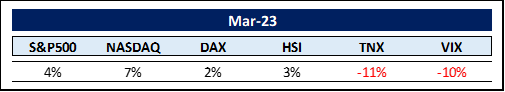

The Rest …

Facing major financial upheavals, world stock markets had a surprisingly uneventful March moving higher with astoundingly low volatility measured by the VIX (CBOE Volatility Index).

Bonds on the other hand, painted a different picture. The MOVE Index – a gauge of implied volatility in the Treasury market – surged to 182 on March 20th, its highest level since 2009. The creator of the index, Harley Bassman, posited a MOVE above 150 is a symptom of the Fed losing control. Perception seems to have calmed down somewhat taking the MOVE back down to 136 since.

The Yield Curve (10/2 years) is still inverted, however decreasing from -89 bps to -57bps.

Figures from ZipRecruiter and Recruit Holdings, two large online recruiting companies, show the number of job postings on their sites declined more than the Labor Department report on job openings indicated, providing the Fed with another argument to stop raising interest rates.

One area of the economy often overlooked is the Shadow Banking system. The term was originally coined by PIMCO‘s Paul McCulley in 2007. Shadow banks are exempt from government oversight and regulation as they do not hold any ordinary customer deposits. What falls under the definition of a shadow bank, are private equity and venture capital funds collecting accredited and institutional investors’ monies and investing these in privately held companies or into artificial financial constructs such as the infamous ABMs (asset backed mortgages).

According to Bloomberg, global shadow banks manage the astounding sum of US$ 250 trillion. As alluded to earlier, many of these funds were placed in illiquid and at times overpriced startups or fanciful derivatives constructs. This is an accident waiting to happen that is not being addressed properly.

One particular sector experiencing its own kind of winter, is Biotech. Just in Q1 2023 alone, the Biotech sector is lagging the NASDAQ by an outsized -27% with many companies trading at or even below cash levels. At least, these are rather liquid investments contrary to the ones the shadow banking industry is nurturing.

On a brighter note, China seems to be recuperating quicker than anticipated. An official gauge of manufacturing rose at the fastest pace in more than a decade, while export orders expanded for the first time in almost two years. This bodes well for alleviating supply chain bottlenecks and invigorating the world economy in general.

We still face eventual liquidations from the shadow banking world, as well as the financial fallout reaching regional banks, however, it does not help sticking one’s head in the sand like an ostrich. There are always opportunities. Investing legend Peter Lynch put it succinctly: “Far more money has been lost by investors trying to anticipate corrections, than has been lost in corrections themselves.”

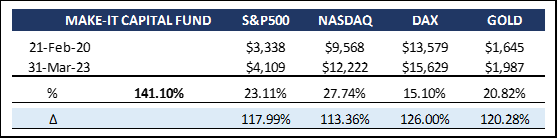

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund empowers investors to participate in the entire distributed ledger / crypto-asset spectrum with just one investment.

- The main objective of the Fund is reducing risk and volatility by employing its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- It is open to institutional and accredited investors world-wide.

- Open-end structure with a minimum investment of $50,000.

- The Fund is fully transparent and always trades at exactly NAV.

The Fund had its second best Q1 in its history (just 2021 was even better). Crisis led to opportunities, in this case precious metals and their mathematical cousin, Bitcoin.

Not many know this, but the first block on the bitcoin blockchain — known as the Genesis Block — includes a secret message. It reads: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Satoshi Nakamoto was referring to a headline from The Times drawing attention to the high probability of yet another UK bank bailout. Bitcoin was created to provide an alternative to the broken financial system and it is currently behaving just as envisaged by its genius inventor(s).

Despite only having a rather short history, we can already derive certain price patterns for bitcoin. About every four years, the rewards for miners securing the Bitcoin network is cut in half, hence the event is named the Halving.

What is interesting is that about 850–950 days following the Halving, prices have always bottomed, only to rise for about one year after the next Halving. We are now over 1,050 after the 3rd Halving (May 11, 2020) and not surprisingly have experienced an amazing rally during the last three months. As the 4th Halving is expected to occur around March/April 2024, we might expect the good times to roll until Spring of 2025.

In this spirit, I’d like to close with another quote from Hegel: “We learn from history that we do not learn from history”.

With regard to world politics and perhaps even human nature itself, Hegel might have hit the nail on its head. Managing the Make-It Fund, however, we try to refute Hegel by learning from history positioning the Fund to profit from the “historically” fruitful times ahead.

Thank you for your time and attention.

Sincerely,

Philipp L. P. von Gottberg

PS — If you would like to delve deeper into Cooper & Kirk’s line of thought, here is a direct link to the relevant white paper “Operation Choke Point 2.0: The Federal Bank Regulators Come For Crypto”:

https://www.cooperkirk.com/wp-content/uploads/2023/03/Operation-Choke-Point-2.0.pdf