Make-it Capital Edition #36

The World of Cryptocurrencies

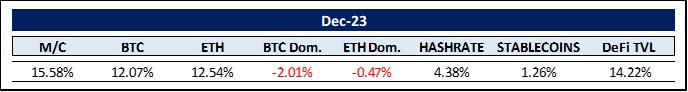

December was another strong month for cryptocurrencies. The overall market increased by $233 billion to $1.725 trillion. Despite an increase of 12% each both Bitcoin (BTC) and Ethereum (ETH) lost market dominance to other layer 1 networks such as Solana (SOL) and Avalanche (AVA).

The hash rate reached new highs, further consolidating the Bitcoin network. Decentralized finance total value locked (DeFi TVL) ended the year markedly higher increasing 74% in 2023.

Although this has been discussed extensively elsewhere, we need to address the current state and possible implications of the spot BTC ETF applications. The U.S. Securities and Exchange Commission (SEC) is expected to approve a Bitcoin ETF soon. Bloomberg Intelligence analysts put the chances of a green light at 90% by January 10, 2024.

BlackRock, Fidelity, Invesco, Franklin Templeton, WisdomTree and Ark Invest among others are all lining up to have a Bitcoin ETF approved by the SEC. With pooled assets of USD 17.7 trillion, it is assumed that an unprecedented amount in new investment capital will flow into BTC in the short term. In addition, BTC spot ETFs increase the acceptance of BTC as an asset class for institutional investors as they are subject to a regulated structure. By way of comparison, gold rose by 500% in the 8 years following March 28, 2003, when the first gold ETFs were approved.

On the other hand, Blockchain data firm CryptoQuant said in a recent report that the approval of the investment vehicle could be a “sell the news” event, as investors are currently sitting on big profits ahead of the potential launch. The Singapore-based firm added that this could result in the price of BTC falling to as low as $32,000 per coin.

Ultimately, however, whenever increased demand meets limited supply, prices will rise regardless of the short-term psychological effects. Should we see a “sell the news” event, the Make-It Capital Fund will certainly increase its BTC positions.

Let’s take a closer look at the supply/demand situation for BTC. On the supply side, 15.4 million of the current 19.6 million BTC are in firm hands, which means that they have not been moved for many months. And of the 4.2 million BTC that are apparently for sale, an estimated 2.5 million have disappeared, been replaced or simply lost. This leaves only 1.7 million actively traded BTC. At a price of 42,000 dollars, this corresponds to a value of $71.4 billion or around 8.5% of BTC’s market capitalization.

That’s the supply side, now let’s examine the demand. Blockchain data company Glassnode estimates that up to 70 billion US dollars in new capital could flow into BTC after a BTC spot ETF is approved. This already matches the total liquid supply.

In addition to the ETF-driven increase in demand, there is also the tokenization of real world assets (RWAs). A market that has the potential to eclipse the BTC-ETF effect. You don’t think that’s possible?

Well, a recent survey by BNY Mellon found that 97% of institutional investors believe that RWA tokenization will revolutionize asset management. We are at the threshold of a new financial era secured by blockchain technology.

To this end, we urgently need realistic and practicable rules and regulations for the entire crypto and blockchain space. Despite the unwavering efforts of some mainly US-based individuals and institutions, such rules and regulations are about to be introduced. According to a new report by PriceWaterhouseCoopers, a total of 42 countries have introduced crypto-related regulations and laws in 2023, suggesting that wider adoption of cryptocurrencies is underway globally.

Another important factor for the surge in demand is the fourth Bitcoin halving in April 2024, which has led to a significant increase in BTC prices on all three previous occasions.

The balance between supply and demand definitely seems to have shifted towards the demand side. Therefore, it could well be that we reach and surpass the previous all-time high for BTC of $67,657 from November 8, 2021 during the remainder of this year. This quote was published some 200 years ago and is astonishingly valid for the acceptance and adoption cycle of new technologies:

“Every truth passes through three stages before it is recognized. In the first it is ridiculed, in the second it is opposed, in the third it is regarded as self evident” – Artur Schopenhauer.

We are exiting the opposition phase and are on the cusp of entering the self-evident phase for cryptocurrencies.

The World of Commodities

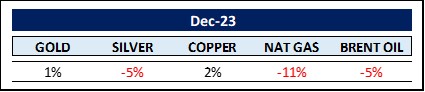

Gold gained around 13% in value in 2023, while its cousin silver remained flat increasing the Gold/Silver Ratio to 86:1.

Historically, both gold and silver have been used in trade. The exchange rate between the two metals was set at 8:1 in ancient times. At the time of Hamurabbi in Babylon (1810 – 1750 B.C.), the ratio was about 6:1. In ancient Egypt, it fluctuated widely, ranging from 13:1 to 2:1. In Rome, it was about 12:1 (although Roman emperors routinely manipulated the ratio to suit their needs). In the United States, the ratio was set at 15:1 in 1792. And in the 20th century, it averaged 50:1, but because gold is still traditionally considered a safe haven, the ratio tends to rise dramatically in times of crisis, panic and economic downturn. Just before the Second World War, when Hitler invaded Poland, the ratio reached 98:1. In January 1991, when the first Gulf War began, the ratio reached 100:1, double its normal value. At 86, the ratio remains elevated, reflecting the current geopolitical and financial instability.

Natural gas lost a further 11%, bringing the annual decline to -44%. Crude oil (we are watching Brent crude) fell by 5% and recorded an annual loss of -9%, despite the embargo on Russian oil and widespread OPEC-led efforts to raise the price. On the other hand, we have learned that Russia is earning more from its oil exports than before its attack on Ukraine. Well. Be that as it may.

Also in the oil space, Angola announced it was leaving OPEC after 16 years of membership as part of a dispute over oil production quotas as the cartel tries to prop up world prices. There is “no impact on supply forecasts as Angola is already producing at full capacity and is not constrained by OPEC+ quotas,” said Richard Bronze, head of geopolitics at consultancy Energy Aspects Ltd. “It has no direct impact on the quotas or production plans of other OPEC+ countries.”

In previous years, such a development would not have occurred because Saudi Arabia would have ensured discipline by increasing production to push down prices. The fact that Saudi Arabia can no longer absorb such a fiscal blow suggests that OPEC is no longer acting as much of a swing producer as it did in the past. This is due to both domestic budget commitments and the growing supply outside OPEC, particularly in the USA, which has become the leading oil-producing country with a production volume of around 20 million barrels per day.

The biggest winners in the commodities sector in 2023 were uranium (+89%), orange juice (+68%) and cocoa (+63%). The biggest losers were lithium (-81%), coal (-66%) and rhodium, which is used in catalytic converters (-64%).

Nuclear fission is experiencing a revival, while the electrification of motor vehicles has stalled considerably (at least in the US and Europe). There are plausible reasons for both developments, however, their analysis would go beyond the scope of this Edition #36.

The Rest …

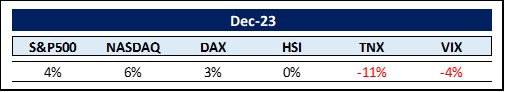

Western stock markets had another bumper month, taking the annual gains for the NASDAQ to 43% albeit mostly led by the Magnificent Seven — namely Meta, Amazon, NVIDIA, Tesla, Apple, Microsoft, and Alphabet.

Volatility as measured by the VIX has fallen by 43% over the year, while the infamous inverted yield curve has shrunk by 31% to 36 basis points.

The hedge fund asset class struggled in 2023 but recovered from the performance of 2022, delivering an annualized return of 8% in 2023, almost offsetting the negative returns of 2022. Hedge fund assets under management (AUM) were estimated at $4.37 trillion by the end of the third quarter of 2023 – an increase of 5%.

It could be the time for small caps to shine. Tom Lee, former chief equity strategist at JPMorgan and co-founder of Fundstrat Global Advisors, believes that inflation is now under control, and since small caps have been the hardest hit by high borrowing costs, the expected change in monetary policy should be a boon for these assets. In his opinion, small caps should rise by 50% in 2024. Michael Wilson, senior equity strategist at Morgan Stanley, shares his view claiming that small caps are trading at a 30% discount to their large-cap counterparts.

The Chinese markets, on the other hand, had a tough year and lost -14% as measured by the HSI. Many commentators believe that China’s valuations are low for a reason. Uncertainty about the future course of government policy and a lack of willingness to provide liquidity have weighed on performance over the course of the year. The mood in economic circles seems to be so bad that even the unspeakable has become sayable: criticism of head of state Xi Jinping. This is sacrilege, but many have little or at least less to lose. “Ultimately, trust in the ability of a highly non-transparent state and its president to find solutions is dwindling,” writes Martin Benninghoff from Handelsblatt.

In a recent article by Louis-Vincent Gave, however, Louis-Vincent points to China’s rise in the export value chain, which shows where the country is heading in its metamorphosis. “Back in 2017, the value of Chinese exports to ASEAN economies amounted to 60% of China’s exports to the US. Today, China’s exports to Southeast Asia stand at roughly 120% of China’s exports to the US.“

China has achieved this by moving up the value chain and exporting decent quality, aggressively priced capital goods and other higher value-added products. The most visible example of this is how China rose from nowhere five years ago to become the world’s largest car exporter. But it’s not just about cars.

You can draw parallels with power plants, earthmoving equipment, tractors, telecom switches, turbines and machine tools — basically all capital goods that are in high demand in India, Indonesia, Brazil and Saudi Arabia. China has focused its stimulus efforts on supporting the export growth model. This has allowed the country to move up the manufacturing value chain and ensure that the turnaround in the real estate market has not led to mass unemployment. This new direction could reinvigorate the Chinese economy.

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment.

- The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- The Fund is fully transparent and always trades at the exact NAV

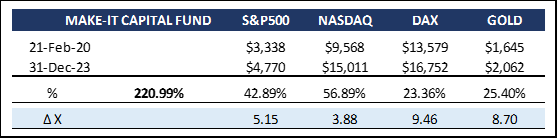

The Fund had an absolutely amazing year, and based on historical precedent as well as our above analysis of supply/demand imbalances, we expect 2024 to be another banner year.

In addition, we have established our new sophisticated arbitrage and market making network, markedly strengthening pillar no.3 (of our 5-pillar investment strategy). In a recent interview, Real Vision CEO Raoul Pal explained that he expects a lot of new financial stimulus in 2024. And in his opinion, stimulus is just another word for currency debasement. The most damaging method of financial stimulus is printing money to put on the central bank’s balance sheet to buy debt, because in reality it’s just debasing the currency. The result is that the purchasing power of assets falls. “If you divide the S&P by the central bank’s balance sheet, the result has been zero performance since 2008. Gold is even negative. Real estate: zero. Only technology stocks and cryptocurrencies have outperformed the devaluation of the currency.“

To put this quote in perspective, Raoul Pal has almost 100% of his assets in crypto-related investments. We do not suggest this. Rather, we adhere to our guideline which recommends an allocation of 1-5% of investment capital to this area – and the Fund is an ideal vehicle for this.

May I leave you with Marcus Aurelius: “Learn to ask of all actions: Why are they doing that?, starting with your own.”

To a successful, healthy and more peaceful year 2024.

Thank you for your time and attention.

Sincerely,

Philipp L.P. von Gottberg