THE WORLD AS WE SAW IT IN JULY 2023

The World of Cryptocurrencies

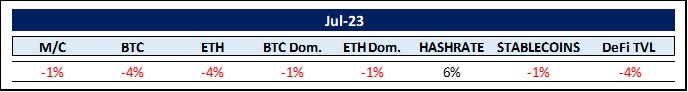

The crypto market was pretty flat in July, with some altcoins gaining ground against the two bellwethers, Bitcoin (BTC) and Ethereum (ETH). The hashrate, or difficulty level of the Bitcoin network, continues to rise, increasing its inherent security. So this is a positive sign for the market as a whole.

“Bitcoin is more stable than stablecoins“. The background for CZ’s (of Binance fame) comment lies in the low volatility Bitcoin has experienced over the last month. However, he could have just said so but referenced stablecoins instead. And for good reason.

Pax Dollar and Gemini Dollar have lost a combined $644 million in market cap, or -44% and -37% just in July. The stablecoin market seems ripe for breakthrough innovation, as USDT (Tether) now commands 68% of the total. FDUSD (First Digital USD) attempts to fill this increasing gap between USDT and the rest. CZ added it to the Binance chain and it reached a respectable $150 million market cap within a few days. FDUSD seems to be worth watching; it claims to be 100% backed by USD and is based in Hong Kong.

After the “Genslering” of BUSD (Binance USD), which resulted in a loss of $18 billion in market cap, it seems CZ is looking for a new alternative stablecoin and FDUSD might just be it. Let the stablecoin wars begin.

The Spot BTC ETF saga, currently in its 28th inning, recently got a little more interesting. Last month we reported on BlackRock‘s application and its chances of overcoming the remaining hurdles. As a reminder, if BlackRock’s application is approved, it would have a huge impact on the underlying bitcoin price. After all, if Blackrock were a country, it would have the third-largest economy in the world, just behind the U.S. and China.

Interestingly, we appear to be getting closer to approval as Grayscale, a crypto asset management firm, has re-entered the race. Grayscale FOMOed in, notifying the SEC to say that BlackRock’s SSA (Surveillance-Sharing Agreement) with Coinbase was not sufficient for approval. That seems odd until you learn that DCG (Digital Currency Group), Grayscale’s parent company, has a multi-billion dollar deficit that needs to be filled. Grayscale’s Chief Legal Officer, Craig Salm, added, “The SEC shouldn’t choose winners and losers.”

This seems to be a last-ditch effort to prevent BlackRock from gaining the first-mover advantage. Eventually, the Spot BTC ETF will become a huge cash cow once it is legalized.

Now to some regulatory news: Two new promising crypto bills have been introduced in the U.S. The first bill (Financial Innovation and Technology for the 21st Century Act) aims to classify all digital assets as either securities or commodities, focusing on the degree of decentralization and functionality. The bill goes so far as to include procedures for relabeling existing securities as commodities.

The second bill (Blockchain Regulatory Certainty Act) aims to make it easier for miners, validators, and wallet providers in the U.S.: they no longer have to register as money transmitters. The bill aims to remove barriers to blockchain development.

If the U.S. wants to remain at the center of such blockchain development, it must create a legal framework as soon as possible. The exodus of capital and skilled workers from the U.S. to more liberal and blockchain-friendly countries is already in full swing.

One of the biggest events in July was the unveiling of Sam Altman’s latest project, Worldcoin (WLD). In his quest to further digitize the planet, its inhabitants are enticed to have their retinas scanned at “Orb outposts” for a contribution of 25 WLD, currently equivalent to about $50. In addition, those so scanned receive a World ID, a digital representation of themselves that supposedly provides KYC-free access to the Internet, banking, and even government programs such as Universal Basic Income (UBI).

Apparently, all captured retinal scans are converted into unique iris codes before being permanently erased to ensure anonymity. Says Sam, “This lets you prove you are a real and unique person online while remaining completely private.” Be that as it may, it’s hard to believe that these uniquely identifying retina records will ever be deleted once they are captured.

All of this raises our feathers and has our privacy alarm geese honking. The combination of a digital ID with any form of centralized payment system could usher in a new era of government surveillance that makes Orwell’s visions seem desirable.

The World of Commodities

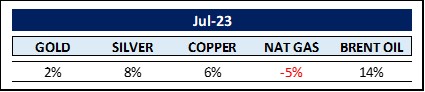

Hoping for a soft landing in the U.S. and a revival of Chinese demand, commodities, except natural gas, have experienced a stealth rally in July. Natural gas is down an amazing -68% year over year and -41% in 2023 alone, though.

The chip war between China and the U.S. is intensifying. In retaliation for the U.S. ban on the latest AI-specific semiconductors, China will require licenses to export gallium and germanium starting Aug. 1. Not surprisingly, China is by far the world’s largest supplier.

Both elements are required for the manufacture of semiconductors. Germanium (Ge), which is more difficult to obtain than gold, is used for optical applications and is required for infrared devices, solar panels, fiber optic cables, and lenses. Both commercial and military semiconductors are made with gallium (Ga). This substance even surpasses silicon when it is present as gallium arsenide (GaAs). According to a statement from China’s Ministry of Commerce, these new regulations are intended to “safeguard national security and interests“. Sounds familiar?

China’s former Vice Minister of Commerce Wei Jianguo recently warned that these metal restrictions are only the beginning of Beijing’s countermeasures. It is widely known that China also dominates the world market for rare earths, which are used in almost every aspect of the modern technology sector.

Back in 2010, China cut its exports of rare earths and prevented them from being shipped to Japan when tensions flared between the two countries. You don’t need a gallium-powered supercomputer to predict China’s next moves.

Treasury Secretary Janet Yellen voiced what many concerned business leaders are thinking: “It would be disastrous for us to attempt to decouple from China. De-risk, yes. Decouple? Absolutely not.”

Now to our friend Dr. Copper: According to Standard & Poor’s (S&P), total demand for copper is expected to triple by 2050, largely due to rising demand from electric vehicles and renewable energy generation. According to S&P, “the amount of copper needed between 2022 and 2050 is greater than the total copper consumed globally between 1900 and 2021” Daniel Howard Yergin refers to copper as “the next oil” for this very reason. Although copper is still cheap, it is rare and makes up only 0.0068% of the earth’s crust.

Turning to grains, despite scaremongering about war-related supply shortages, the FAO’s (Food and Agricultural Organization of the United Nations) new forecast for global grain production in 2023 has been raised to 2,819 million metric tons, reaching a new record high. Prices are reflecting this with wheat prices down -21% year-over-year.

The Rest …

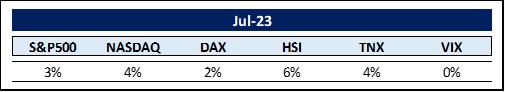

Markets continue to be driven by two interlocking forces: Inflation and interest rates. Inflation is falling sharply, catapulting leading indicators upward, despite the Federal Reserve’s (Fed) recent actions, which are difficult to understand.

So far, we are still in the disinflation phase, where the inflation rate is still rising, but just more slowly than before. However, that is about to change. In a recent interview, Emad Mostaque, founder and CEO of Stability AI, said that 80% of inflation in recent years has been driven by higher education and healthcare costs. Both will soon be impacted by AI, which will put significant downward pressure on inflation.

At its last meeting, nonetheless, the Fed raised interest rates by 0.25% (25 basis points). After 11 hikes in just 17 months, this resulted in the federal funds rate reaching its highest level in 22 years. We are now entering a period in which the U.S. government is paying historically high-interest rates on its debt obligations, amounting to nearly $1 trillion in interest alone, excluding amortization, mind you. That exceeds the entire annual military budget. So the question is: How much further can this go?

It seems like every economist has called for a serious economic downturn – only where is the recession? From the Fed’s recent announcements, one can conclude that this time we will forgo a recessionary downturn and land rather softly.

Really? After all, an inverted yield curve, the most reliable recession indicator, has been in place for exactly 12 months, even though it narrowed to 92 basis points in July (from 105 basis points in June). However, the longest period between an inversion and the subsequent recession was 16–17 months (1928), at that time indicating a full-blown depression, not just a recession. The word is still out.

One might wonder why the economy is holding up so well. Besides the enormous amounts of liquidity still in circulation following QE measures, the mortgage industry could be another reason. Here, a significant amount of money is tied to low-interest rates for extended periods of time. The Bloomberg MBS Index shows that the average coupon is still below 3%. Family mortgages, worth $13.5 trillion, have been virtually unaffected by the Fed’s recent rate hikes.

On to the U.S. Dollar (USD): Apparently, with Russia’s support, the BRICS countries (Brazil, Russia, India, China, and South Africa) have proposed the introduction of a “gold-backed” currency to counterbalance the “credit-backed” USD system. And more countries are lining up to join. According to a recent report by The Cradle, Algeria, Bahrain, Egypt, Iran, Saudi Arabia, and the United Arab Emirates have officially applied to join the BRICS bloc.

Marc Chandler, managing director of Bannockburn Global Forex, sees this development as follows, “Talk of BRICS gold-backed currency seems like an echo chamber. They do not have the gold to back a currency in any meaningful way” … and … “Have we learned anything from the EMU experience of monetary union without fiscal union. Color me profoundly skeptical.”

Be that as it may, debt creation has its limits. Even if the USD is not replaced as the world’s reserve currency in the foreseeable future, it is clear that we cannot go on like this forever. Here are some wise words from Adam Smith: “History shows that once a nation has accumulated significant debt, there are only two ways to repay it: One is to simply declare bankruptcy – repudiate the debt. The other is to devalue the currency, destroying the prosperity of the common citizen.”

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger/crypto assets with just one investment.

- The Fund set out to reduce inherent risk and volatility by employing its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- It is open to institutional and accredited investors worldwide.

- Open-end structure with a minimum investment of $50,000.

- The Fund is fully transparent and always trades at the exact NAV.

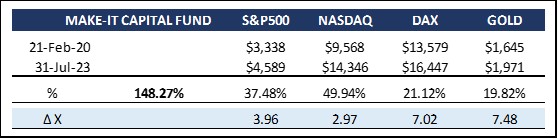

Despite being struck by extreme volatility and a protracted crypto winter, the Fund is crushing it achieving multiples over investment alternatives at 3.96x the S&P500, 2.97x the Nasdaq, and 7.48x gold.

When the head (Larry Fink) of the dominant global asset manager (BlackRock) does a complete about-face and starts promoting Bitcoin, you know the tide has irrevocably turned: “Instead of investing in gold as a hedge against inflation, as a hedge against the pesky problems or devaluation of your currency, no matter what country you’re in – let’s be clear that Bitcoin is an international asset, it’s not based on any particular currency, and therefore it can be an asset that people can play as an alternative.”

Everything is coming together for the next bull market: institutional legitimacy, record-breaking computing power to support BTC, removal of psychological barriers, the decline in BTC issuance, and concerns about fiat currency devaluation.

Further, as we have described in these market commentaries, bitcoin bottoms about 900 days after its last Halving. We are now 250 days past that bottom. And the bitcoin price has risen significantly since then, showing us that the original investment thesis is working well. However, this particular bull market has just begun and, supported by fundamentals and technicals, will last at least until early 2015.

Cryptocurrencies, and Bitcoin, in particular, are long-term secular investments. The U.S. government seems to disagree. Having seized 195,091 bitcoin since 2014 and subsequently having sold the seized bitcoin, it has gained $366,493. Hurrah! Had it simply kept the bitcoin, it would now be sitting on the equivalent of $5.85 billion.

Rest assured, your fund managers will ride the entire wave for you, be it for 10, 20, or more years.

Thank you for your time and attention.

Sincerely,

Philipp L. P. von Gottberg