| THE WORLD AS WE SAW IT IN AUGUST 2025 |

| The World of Cryptocurrencies |

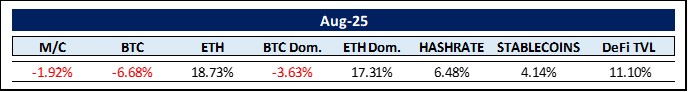

In a changing of the guard move, Ethereum (+18.7%) stole pole position from Bitcoin (-6.7%) in August. K33′s head of research, Vetle Lunde, has shown that a whale rotation of 22,400 BTC directly into ETH helped drive Ethereum to a new all-time high of $4,956 in August, manifesting a Bitcoin-to-Ethereum rotation. This was also reflected in the inflows and outflows of spot ETFs. While the total outflows of all Bitcoin spot ETFs amounted to -$751 million for the month, Ethereum spot ETFs recorded monthly inflows of $3.87 billion. As a result, the BTC/ETH ratio for August fell from 31.31 to 24.60.

The last time Ethereum reached a record high was in November 2021. Since then, however, the USD value of all major stablecoins on the blockchain has increased by 64% to $287 billion. Tom Lee, chairman of Ethereum treasury company BitMine, recently explained the direct implications for Ethereum: “Stablecoins are the ‘ChatGPT’ of cryptocurrencies. And Ethereum is the backbone. It’s legally recognized and has zero downtime.” The institutional arm of Coinbase predicts that stablecoins will swell to a $1.2 trillion market by 2028, while Matt Hougan, CIO of Bitwise, believes the market for dollar-pegged stablecoins to reach $2.5 trillion “in no time.”

As far as tokenized real-world assets (RWAs) are concerned, the opportunity could be even greater. RWAs are the bridge between TradFi’s trillions and crypto’s code. These tokenized versions of traditional financial assets such as personal loans, US government bonds and commodities, have grown from virtually nothing to a market of $27.92 billion. An April report by Ripple and the Boston Consulting Group predicts that the combined market for tokenized assets will reach $19 trillion by 2033. Ethereum (including its Layer 2s – Polygon, Arbitrum, Optimism, Base) also dominates this explosive market with 89% of all RWAs on its ecosystem. As Ethereum is already home to by far the largest DeFi ecosystem, it is in the best position to capitalize on both stablecoins and RWAs, leading to medium-term price projections of $15,000 per ETH.

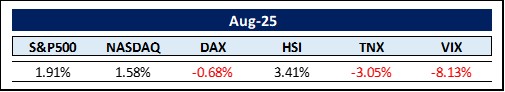

Let’s move on to the bigger picture of the capital markets in general. The following sentence was clearly the most influential for the capital markets in August: “With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Jerome Powell thus struck a more dovish tone than expected in his keynote speech at the Federal Reserve’s annual economic policy symposium in Jackson Hole on August 22, 2025. In his speech, he highlighted a shift in economic risks, emphasized a weakening labor market, and hinted that the Federal Reserve could begin cutting interest rates as early as 17 September to address these concerns, while noting that inflation risks, though still present, have diminished. This sparked a buying frenzy in everything crypto lightning a fire that had been prepared in the weeks prior.

A major part in preparing the crypto bonfire can be attributed to SEC Chairman Paul Atkins, who spoke at the America First Institute on July 31. His speech followed the White House publication of the 166-page document “Strengthening American Leadership in Digital Financial Technology” just one day prior on 30 July. In his speech, Paul Atkins, caused quite a stir when he presented “Project Crypto” – a Commission-wide initiative “to modernize the securities rules and regulations to enable America’s financial markets to move on-chain.” We’ve got to listen closely here. That’s a whole new dimension. Atkins wasn’t talking about how to bring crypto and digital assets into our financial system; he was talking about how to move the entire financial system to crypto and on blockchains. This gigantic step represents a complete revolution of the financial world as we know it. It is clearly a once-in-a-lifetime situation that is setting off a whirlwind of innovation and investment opportunities.

Caroline Pham, the acting chairwoman of the Commodity Futures Trading Commission (CFTC), was not to be left behind saying on August 4: “The CFTC is full speed ahead on enabling immediate trading of digital assets at the Federal level in coordination with the SEC’s Project Crypto.” All hands are on deck to drive this financial revolution forward.

Matt Hougan, the CIO of Bitwise, commented shortly after Atkins’ speech was published, saying it was “the most bullish document I’ve read on crypto that wasn’t written by some yahoo on Twitter. It was written by the chairman of the SEC.” Hougan named three investment opportunities that stand out. First, Ethereum and other Layer 1 blockchains that enable tokenization and stablecoins, as they form the backbone of the financial system. Then he mentioned “super apps” such as Coinbase and Robinhood, which allow access to all assets from one account. Finally, he touched on decentralized finance (DeFi), as an entire financial economy is emerging with DeFi being the key to the protocols that are the pillars of this new economy.

As CoinTelegraph reports, Bitcoin is making up an increasing share of the world’s money supply as central banks continue to print money and reduce purchasing power. Bitcoin’s share of the global money supply has risen to around 1.57%. This figure includes the aggregate M2 money supply of all major fiat currencies and the largest minor currencies ($112.9 trillion), as well as the market capitalization of gold ($25.1 trillion – excluding silver, platinum, and exotic metals like palladium). All cryptocurrencies together account for 2.79% of the above-mentioned money supply.

Bitcoin is increasingly finding new buyers, not only among companies (DATs – digital assets treasuries) but also among nation states. The Philippines for instance is considering the establishment of a strategic Bitcoin reserve through House Bill 421, introduced by Congressman Miguel Luis Villafuerte. The bill provides for the central bank to purchase 2,000 BTC annually for five years (totaling 10,000 BTC) and hold them for a period of 20 years – after which the government can sell the BTC to pay off debt. It includes strict requirements for trust asset management, reporting, custody, and proof of reserves to ensure transparency. Villafuerte argued that stockpiling Bitcoin is essential for national financial stability. If the law is passed, the Philippines would join Pakistan, which has announced similar plans, as a pioneer in Asia for a legally regulated state Bitcoin reserve.

A recent survey by Bank of America showed that despite all the bullish momentum, most global fund managers are still reluctant to invest in cryptocurrencies. The study, which involved 211 fund managers managing $504 billion in assets, found that around 75% of respondents do not own any cryptocurrencies at all. The crypto allocations of the managers who do hold crypto, on the other hand, are low. On average, only 3.2% of these portfolios are invested in digital assets. Broken down, this means that 6% of managers have around 2%, 2% have 4%, and only 1% have more than 8% invested in cryptocurrencies. On average for the group as a whole, cryptocurrencies account for just 0.3% of assets under management.

The host of The Scoop podcast, Frank Chaparro, commented, “Wall Street has barely gotten off zero and Bitcoin is still at $120,000. We are going to go absurdly higher.” Eric Balchunas, ETF analyst at Bloomberg, also commented on these results, and suggested that the low exposure could be due to previous missteps by these funds. He noted that some managers who had previously made poor calls on the broader markets might be particularly wary of the fast-growing crypto sector, “Aren’t these the same ‘global managers’ who said in the first quarter that they were going to sell America? Maybe they should start surveying people with better returns.” It doesn’t seem too far-fetched that these same managers will change their minds sooner rather than later, adding yet another demand layer for crypto.

Do you remember the famous statement by the former chief economist of the International Monetary Fund and current Harvard Professor of Economics, Kenneth Rogoff, in 2018 that Bitcoin would rather go to $100 than $100,000? In 2018 mind you, the average closing price for Bitcoin (BTC) was $7,572.30. Boy was he wrong. He blames his momentous miscalculation on underestimating how much Bitcoin would compete with fiat currencies to serve as the preferred transaction medium in the $20 trillion global underground economy (which apparently accounts for about 11.8% of global GDP). “This demand has put a floor on its price.” But that really seems far-fetched. Estimates from sources such as the UN and the World Economic Forum suggest that cryptocurrencies facilitate a small but growing proportion of illicit activities, such as money laundering or purchases on the dark web, but these remain a subset of the underground economy. Rather, fiat currencies, especially USD cash, appear to account for over 90% of the $20 trillion underground economy. Why can’t he just admit he was dead wrong? Here is the American author of over 100 books John C. Maxwell: “A man must be big enough to admit his mistakes, smart enough to profit from them, and strong enough to correct them.”

In its latest report “Bitcoin and Cryptocurrencies: The Future of Finance“, German insurance giant and $2.5 trillion asset manager Allianz Group clearly corrected their mistake by endorsing Bitcoin as a “credible store of value“, pivoting from their anti-crypto stance from 2019. Allianz now describes Bitcoin as a fundamental element of modern portfolio construction. They even go so far as to declare Bitcoin and other digital assets a cornerstone of the global financial system. The report attributes this shift to the increasing clarity of global regulation, the maturing of financial infrastructure (including spot ETFs, custodians, and bank-backed services), and a growing trend towards strategic allocation by corporations (DATs), universities, foundations, and even sovereigns. Although Bitcoin is the focus of the report, Allianz also see significant potential in other cryptocurrencies, particularly Ethereum (ETH) and other Layer 1 platforms, for the next generation of financial infrastructure through innovations such as RWAs and DeFi.

Coming back to stablecoins: The Wyoming Stable Token Commission (WSTC) has announced the mainnet launch of the first official US state-backed stablecoin dubbed the Frontier Stable Token (FRNT). FRNT is at least 102% over-collateralized with cash and short-term US Treasury securities managed by Franklin Advisers, and overseen by Inca Digital. It debuts on seven blockchains: Arbitrum, Avalanche, Base, Ethereum, Optimism, Polygon, and Solana. Will it pave the way for many more state-backed stablecoins? You bet.

Meanwhile, China is actively considering the introduction of yuan-backed stablecoins to promote global adoption of its currency, a marked departure from its previous ban on cryptocurrency trading and mining in 2021. According to multiple sources, China’s State Council is expected to consider a roadmap for the approval of yuan-backed stablecoins very soon, with Hong Kong and Shanghai being the main hubs for implementation. Hong Kong’s new stablecoin regulation, which came into effect on August 1, 2025, positions it as a pioneer in regulating fiat-backed stablecoins, while Shanghai is establishing an international operation center for the digital yuan. The plan aims to counter the dominance of US dollar-denominated stablecoins, which currently account for over 99% of the global stablecoin supply, and promote the use of the yuan in cross-border trade.

Like their US counterparts Amazon and Walmart, who are planning their own USD-backed stablecoins, Chinese tech giants such as JD.com and Ant Group are championing yuan-backed stablecoins. However, challenges remain. Notably China’s strict capital controls, which could hinder the free flow of yuan-backed stablecoins while raising internal concerns about capital flight. Despite these hurdles, the People’s Bank of China (PBOC) and other regulators are tasked with developing risk prevention guidelines to support this initiative. While no yuan-backed stablecoin has been officially launched yet, the momentum – created by geopolitical tensions, the increasing use of dollar-backed stablecoins by Chinese exporters, and the fear of missing out makes an imminent approval and launch highly likely.

There is an interesting development in the increasingly challenging US treasury markets, namely Bitcoin-Enhanced Treasury Bonds, also called “BitBonds” or “₿ Bonds“. They are a proposed hybrid financial instrument that combines traditional US Treasury bonds with exposure to Bitcoin. The concept has been put forward by the Bitcoin Policy Institute as a novel approach to addressing the US government’s fiscal challenges, particularly the rising national debt and refinancing needs. Some argue that BitBonds allow for budget-neutral debt rollovers. So how do they work?

Approximately 90% of the proceeds from the sale of BitBonds would be used to fund general government spending, while 10% would be used to purchase Bitcoin for a Strategic Bitcoin Reserve (as defined by President Donald Trump in his March 6, 2025, Executive Order). Investors would receive a fixed annual coupon (e.g., 1%, lower than the 4.5% common for traditional government bonds) and a potential payout linked to the price appreciation of Bitcoin at maturity. The government and investors can share the Bitcoin profits above a certain yield threshold (e.g., 4.5% compounded return). Proponents of such a new debt structure, such as VanEck‘s Matthew Sigel, see three positives converging:

- First, BitBonds could lower the interest burden on US debt by offering lower coupon rates.

- Second, they would make it easier to build a Strategic Bitcoin Reserve at no additional cost to taxpayers.

- And finally, they would provide investors with a tax-advantaged savings vehicle that combines the safety of government bonds with the growth potential of Bitcoin.

James Hunt of The Block cites Newmarket Capital and Battery Finance founder and CEO Andrew Hohns who estimates that issuing $2 trillion worth of BitBonds could save $70 billion a year in interest compared to traditional government bonds, which could add up to $700 billion over a decade. If Bitcoin gains significantly in value, the government could further reduce the debt burden through shared profits. While very intriguing, there is currently no concrete evidence that the Treasury is actively planning to introduce BitBonds anytime soon. Legal, technical, and market challenges, as well as the lack of official statements from the Treasury, suggest that BitBonds, regardless of their appeal, remain a speculative proposal rather than an imminent action plan.

Russian banking giant Sberbank meanwhile seems to be further along the path having already issued Bitcoin-linked bonds, paving the way for compliant participation in cryptocurrencies within the regulated Russian financial system. Sberbank, by-the-way, Russia’s largest lender, thus marked an important step towards the integration of cryptocurrency instruments into the country’s regulated financial system. The product, which is currently available on the over-the-counter market to a limited group of qualified investors, offers returns based on the performance of Bitcoin’s value in USD as well as the potential appreciation of the USD against the Russian ruble (reality check: the USD lost some 22.5% in value against the Russion ruble in 2025). Anyhow, according to Sberbank, the bonds eliminate the need to open cryptocurrency wallets or use offshore exchanges, as all transactions are settled in rubles and within the Russian legal and technical framework.

Well, Bitcoin seems to be at the core of many new financial instruments popping up all over the planet. Here is Jack Dorsey, CEO of Block: “Bitcoin is resilience. Its true value emerges stronger after every dip. Stay focused, stay stacking“.

| The World of Commodities |

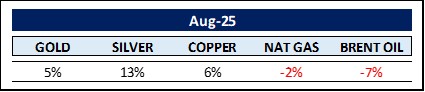

The top three commodities in August 2025 were Coffee (+38%), Neodynium (+20%), followed by Orange Juice (+10%). The bottom three start with Lumber (-20%), followed by Silicon (-10%) and Urea (-10%).

In August 2025, global market price for Arabica coffee rose significantly, driven by supply concerns and robust demand. This sharp increase was fueled by unfavorable weather conditions in key growing regions such as Brazil, where drought fears related to La Niña weather conditions fueled concerns about crop yields. Strong export demand and speculative trading exacerbated the price rise, making coffee this month’s standout commodity.

Orange juice prices have been subject to considerable fluctuations in recent years, driven primarily by persistent supply shortages in the world’s main production regions. While prices reached record highs in late 2024 – over $5 per pound for frozen concentrated orange juice (FCOJ) – prices began to fall sharply in early 2025, dropping by around 50% by March. However, the recent price increase is due to a combination of environmental, biological and economic factors. The most crucial being the Citrus Greening Disease (Huanglongbing or HLB), a bacterial infection spread by the Asian citrus psyllid insect. There is no cure and it causes the trees to produce smaller, bitter, low-juice fruits before dying within a few years. In Florida (accounting for over 90% of US orange juice), HLB has reduced production to its lowest level since the 1930s. In Brazil, which supplies about 70-80% of global orange juice exports (including 76% of US imports), 20% of trees are infested, resulting in a 24% decline in the 2024-2025 crop to 232 million cases – the second lowest since 1988-1989. Combined with declines in the US, global production fell 9% to 1.1 million tons in 2024-2025. Lower supply, same or even higher demand …

Gold remains remarkably resilient. Central banks, particularly in China, India, and Russia, are expected to buy around 900 tons of gold in 2025, to wean themselves off US dollar reserves. Strong investor demand, particularly from gold ETFs (with inflows of 310 tons in 2025) and physical bar and coin purchases (up 44% in China), is supporting price growth. Both Goldman Sachs and JP Morgan Chase believe the gold price could reach $4,000 per ounce by mid-2026, with some scenarios predicting even higher peaks if stagflation or recession threats intensify. However, potential risks such as a stronger US dollar or easing geopolitical tensions could dampen gains. For now, the combination of inflation, a weaker dollar, and strong demand creates a compelling case for a further rise in the gold price. As the current gold-silver ratio (GSR) is still very high at 86.83, let’s take a quick look at silver’s potential. Some analysts believe it is likely to be the stronger performer in percentage terms in 2025 and overtake gold (it is well on its way with a ytd increase of +40% vs +34% for gold) . This is due to industrial demand (over 50% of silver demand comes from industries such as solar panels, electric vehicles, and electronics), supply deficits (2025 is the fifth consecutive year of supply deficits at -149 million ounces, tightening availability), and the undervaluation compared to the post-1970s average GSR of 65. The market capitalization of silver, based on above-ground reserves and the current market price, has reached approx. $2.33 trillion. This is calculated by multiplying the estimated 1,751,000 metric tonnes of silver mined by the current price of around $40.50 per ounce. As such silver has overtaken Bitcoin in terms of market capitalization. Here is silver analyst David Morgan: “Silver is the poor man’s gold, but it’s also the rich man’s opportunity – its volatility and industrial demand make it a unique investment.”

August proved to be decisive for the future of nuclear energy, especially in the USA. The US Department of Energy (DOE) announced its first selection of 11 “advanced nuclear reactor projects” under the newly designed Nuclear Reactor Pilot Program. Advanced nuclear reactors are next generation nuclear fission reactors, specifically small modular reactors (SMRs), which represent the fourth generation of nuclear fission reactor design. SMRs can be manufactured on a large scale at a central location and then assembled and commissioned on site. This reduces both the cost of the fission reactor and the time from start to finish. New SMRs can be commissioned within 3 years of the start of a project, compared to typically 7-12 years depending on the reactor type. The goal is to enable the construction, testing, and successful operation of three pilot reactors by July 4, 2026! China and Russia are far ahead in this race. China alone has commissioned around 3 new reactors a year over the last 5 years and approved a further 10 in April 2025. With the fiercely contested battle for AI supremacy, the US is trying to close the energy gap as quickly as possible.

Moving on to the only currently available alternative to feed the energy hungry data centers in the US – natural gas. What many might not know, in September 2006, commodity trader Brian Hunter single-handedly blew up one of the most prestigious hedge funds in the US, Amaranth Advisors, by making huge leveraged bets on natural gas. In the previous two years, he had made the firm several billion USD with massive long positions in natural gas, while two hurricanes struck the gas infrastructure. However, unusually warm weather in the summer and fall of 2006 led to a massive drop in demand and thus price for natural gas. In consequence, Hunter raked in $6.6 billion in trading losses eventually plunging Amaranth into the abyss.

Then there is coal. While Europe is literally cutting off an arm and a leg to reduce carbon dioxide (CO2) emissions, other countries around the world are pushing ahead with the installation of new fossil fuel-based power generation capacity. Indonesia recently announced plans to build 20 gigawatts of coal-fired power plants over the next 7 years for its own use (electricity for certain industrial plants, not for the grid). China has installed coal capacity at a record pace. In 2024 alone, China has started building 94 gigawatts of coal capacity. These figures are staggering, and to put them into perspective: The average grid load in Germany is 55 GW – so China has added nearly 50% more capacity in a single year than Germany’s total demand, and that’s just for coal. Coal is the most carbon-intensive energy source. Due to the massive expansion of the Chinese power plant fleet, China has long since become the leading emitter of CO2 emissions and there is little sign of the growth in emissions slowing down.

Regardless of whether humanity contributes to or is even responsible for climate change with its share of the 0.042% CO2 in the earth’s atmosphere, such a massive expansion of fossil fuel-fired power plants undoubtedly further exacerbates the pollution of our environment and especially our air.

The Rest …

August and September are historically challenging for equities and, more recently, cryptocurrencies due to a mix of seasonal, behavioral, and market-specific factors. August seems to be driven by the summer lull, i.e. traders simply being on holiday reducing trading volumes, which can amplify negative sentiment due to thin order books.

However, September is clearly the worst performing month of all. This seems to be influenced by three main factors:

- First, institutional investors are adjusting their portfolios, often selling underperforming assets to rebalance their investments.

- Secondly, the market is facing tax-driven selling, especially in the US. For most mutual funds, the tax year ends in October, forcing them to sell their losing positions in September, adding to the downward pressure.

- Finally, there also seems to be a psychological effect. You could call it the post-summer depression, where investors re-evaluate all the positions in their portfolios after the summer break, sometimes leading to sell-offs.

To take above psychological effect one step further, the September phenomenon may have evolved into a self-fulfilling Red September prophecy, as Yuri Berg of FinchTrade recently wrote: “Red September has gone from market anomaly to monthly psychology experiment. We’re watching an entire market talk itself into a selloff based on history rather than current fundamentals.”

Be that as it may, September 2025 offers two compelling catalysts to change the Red September narrative. Fist, the Fed meeting on 17 Septmber where rate custs are widely expected and secondly, the Digital Asset Market Clarity Act of 2025 (CLARITY Act) might pass its final Senate hurdle at the end of September, after the House of Representatives passed the bill on July 17, 2025, with a bipartisan vote of 294-134.

Anyhow, don’t worry; at least in the crypto world Red September (or, to use the crypto term, Rektember) is mostly followed by Uptober (9 of the last 10 Octobers showed average crypto gains of 14%). Let’s hope we avoid a repeat of the October 1929 and 1987 stock market crashes and instead introduce a stock Uptober meme instead.

US dollar money market fund assets (MMF) might help this cause as they have reached an all-time high of $7.19 trillion (as of August 20, 2025) due to a combination of attractive yields, investor caution, and macroeconomic factors. Here is Jack Welsh, former CEO of General Electric: “Cash combined with courage in a time of crisis is priceless“.

Historically, high cash levels have acted as dry powder to fuel further market gains, especially when sentiment moves towards optimism (e.g., due to expected Federal Reserve rate cuts or eased trade tensions). Indeed, the bull market has persisted despite high MMF inflows, suggesting that not all investors are fully invested in equities. This partial participation leaves room for growth as cash that has fallen by the wayside flows into the market, particularly in undervalued sectors such as small-cap stocks, that have lagged mega-cap tech stocks.

In this context, it is often advisable to pay attention when Stanley Druckenmiller speaks. Here is his view on what drives the markets: “Markets don’t move because of value; they move because of money flowing in or out. Liquidity is what makes the engine run“. So, let’s take a closer look at liquidity.

Global liquidity, which includes central bank balance sheets, M2 money supply, and short-term credit flows, follows roughly five-year cycles. Michael Howell, founder of London-based CrossBorder Capital, expects it to peak in late 2025 or mid-2026 (Global Liquidity Index ~70, compared to 90 post-COVID) when the current cycle comes to an end. Liquidity support from global central banks is expected to hit a “debt maturity wall” requiring large-scale refinancing of debt. Global debt (public and private, including government, corporate, and household sectors) reached $324 trillion in Q1 2025, up $7.5 trillion from the end of 2024.

Remember 1998, when the US collected $70 billion more in taxes than it spent, creating its first budget surplus in nearly 30 years? Granted this was mainly due to luck, as tax receipts surprised to the upside thanks to favorable demographics and a booming stock market.

Back to reality though: According to Cointelegraph up to $33 trillion of debt is coming due in 2026, seriously draining liquidity and thus potentially putting a lid on all major investable markets.

Let’s move on to “the most beautiful word in the dictionary” – Donald Trump on “tariff”. It has been more than four months since President Donald Trump first announced far-reaching tariffs. Investors initially feared the worst and dumped their shares. But then Donald Trump set aside the most draconian tariffs in the triple-digit range and investors reconsidered their stance, propagating the TACO meme (Trump always chickens out). This change in sentiment sent shares soaring to new highs.

However, the tariff story is far from over as they will continue to have a negative impact on inflation data in the coming months. Although as mentioned above, Fed Chairman Jerome Powell struck a more dovish tone in what will likely be his final keynote address at the Fed’s annual economic policy symposium in Jackson Hole. We are not out of the woods yet. The sword of Damocles of seemingly arbitrary tariffs will keep investors on their toes.

On the oher hand, extrapolating the US tariffs collected in August (around $37 billion), US customs revenue could reach a record value of $444 billion for the year. That would be almost four times the average of previous years.

Instead of dreaded tariffs, there is a more sophisticated way to achieve the same goal. In a recent interview with the Handelsblatt, US economist Glenn Hubbard, suggested introducing a “destination-based cash flow tax” instead of import tariffs to strengthen the US economy. This would mean that expenditure on foreign goods could no longer be deducted from income, while income from exports would no longer be taxed. According to Hubbard, this would have the same effect as tariffs – without the negative consequences. According to Teresa Stiens, it is questionable whether Donald Trump will be persuaded by this argument though. After all, he has repeatedly emphasized that he loves “tariffs”. “Destination-based cash flow tax,” on the other hand, doesn’t sound quite as sexy. Nevertheless, it is a highly interesting idea.

Talking about interesting ideas; there is quite some talk in DC of a possible Mar-a-Lago Accord along the lines of the Plaza Accord of 1985, with the specific aim of deliberately weakening the US dollar against other currencies. The Plaza Accord was a coordinated attempt by the G5 countries (USA, Japan, West Germany, France, and the UK) to devalue the US dollar by around 40% in order to offset trade imbalances and, in particular, improve the competitiveness of US exports. The success was mixed, as it was not possible to sustainably reduce the US trade deficits due to budget problems (low savings, high borrowings, etc.), which incidentally have still not been resolved today. A revival of the Plaza Accord, aka the Mar-a-Lago Accord, as envisioned by key advisors such as Stephen Miran (Chairman of the Council of Economic Advisers) and Scott Bessent (Secretary of the Treasury), is primarily aimed at reducing the US trade deficit by addressing the perceived overvaluation of the USD theoretically boosting US manufacturing and exports. The idea is based on the argument that the strength of the US dollar, driven by global demand for dollar-denominated assets such as US government bonds and simply by its status as the world’s reserve currency, has hurt manufacturing in the US because exports have become more expensive and imports cheaper, leading to persistent trade deficits.

However, there are always two sides to every coin. A weaker USD would increase import costs, fuel inflation and reduce the purchasing power of US consumers, while increasing borrowing costs, and weakening global confidence in the USD. A revival of the Plaza Accord therefore seems very theoretical but could be targeted for the 40th anniversary of the Plaza Accord on September 22, 2025. On the other hand, the US dollar index (DXY), which measures the value of the dollar against a basket of six major currencies (EURO, yen, British pound, Canadian dollar, Swedish krona, Swiss franc), fell by around 10% in the first half of 2025, which is the worst half-year performance since 1973 anyway, thus reducing the perceived need for a massive coordinated currency intervention to further weaken the USD. On the other hand, former US Treasury Secretary, John Connally reflected in 1971 on the US attitude to the weakening of the dollar during the end of the Bretton Woods system. “The dollar is our currency, but it is your problem.”

Moving on to this important but little-noticed move by Google. Google Cloud has taken its first major step in developing a blockchain infrastructure with the launch of the Google Cloud Universal Ledger (GCUL), a Layer 1 network designed to enable faster payments and settlements across borders. GCUL, which is currently operating on a private test network, is seen by some as a frontal assault on SWIFT. What exactly is SWIFT anyway?

SWIFT, the Society for Worldwide Interbank Financial Telecommunication, is a global messaging network used by banks and financial institutions for the secure exchange of information and instructions for financial transactions. The parent company S.W.I.F.T. SC was founded in Belgium in 1973 and is owned by around 3,500 financial institutions, primarily banks, from over 200 countries. In total, over 11,000 institutions use SWIFT and process 44 million messages every day (2022). It is important to know that SWIFT itself does not move money but only enables the secure exchange of payment instructions between financial institutions. The actual transfer of money takes place via correspondent banking relationships and clearing systems. Blockchain-based systems, which enable direct peer-to-peer transactions without middlemen, make SWIFT’s centralized messaging infrastructure redundant. Member banks, especially those that have invested heavily in SWIFT (e.g. large US and European banks), will lose influence, revenue and control over global payment flows as a result. Will they give up their priviledges without a fight?

Moving on to the world of venture capital (VC). The fundraising of crypto venture capital has fallen drastically since the boom from 2021/2022. In 2022, crypto VC funds raised more than $86 billion in 329 funds, but that sum dropped to $11.2 billion in 2023 and $7.95 billion in 2024, according to The Block Pro data. In 2025, just $3.7 billion has been raised by 28 funds so far, underlining how much more challenging the environment has become. Both the amount of money raised and the number of funds are down sharply, reflecting Limited Partner (LP) caution and a more selective capital base. Family offices, high net worth individuals, and crypto native funds are still active in supporting crypto VCs. Pension funds, endowments, funds of funds, and corporate venture arms on the other hand have largely withdrawn since 2022, leaving a smaller, more selective pool of LPs.

The last bull cycle was unusual — in 2021 almost anyone could launch a crypto VC fund, often without much experience, but many of these funds still haven’t returned any invested capital. Therefore, LPs are now waiting for real distributions on paid-in capital (DPI) before deploying fresh money. Rising interest rates since March 2022 have also prompted funders to invest in safer, more liquid assets.

Furthermore, AI has clearly siphoned off a lot of potential crypto VC capital. To back up this trend with numbers: According to Goldman Sachs, global VC investment in AI amounted to around $94 billion in 2021. This level remained almost unchanged until 2024, when total AI VC investment rose to $100 billion. And in 2025, global AI VC investment has already reached $185 billion, perhaps somewhat distorted by some mega rounds such as the $40 billion raised by Sam Altman‘s OpenAI in the first quarter. Impressive nonetheless. Here is computer scientist and AI researcher Fei-Fei Li also known as the Godmother of AI: “AI is not just a tool; it’s a new paradigm that will redefine industries, economies, and societies in ways we are only beginning to understand.” She is most probably right, and global VC investors seem to agree.

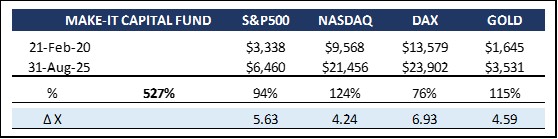

| MAKE-IT CAPITAL FUND (the Fund) |

| As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment. The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy. The Fund is operated by Make-It Singapore and managed by Make-It New Zealand. The Fund is fully transparent and always trades at the exact NAV. |

As we have seen above, August heralded a changing of the guard in the world of cryptocurrencies: Bitcoin lost 6.7% in price and 3.6% in market dominance. Most of this was absorbed by Ethereum, perhaps ushering in the long-awaited altcoin season. The Make-It Fund was able to post some gains despite the overall market losing around -$75 billion in market capitalization.

Chris Cambell recently analyzed the “Mag 7” playbook for crypto. Remember how Apple, Amazon, Google, NVIDIA, Microsoft, Meta, and Tesla carried the entire stock market for a decade? The Mag 7 of cryptocurrencies will define the crypto markets for the next decade. But with more upside potential. Here is a brief overview of the crypto Mag 7: Stablecoins, Smart Contract Platforms, DeFi, Data Infrastructure (Oracles), Real-World Assets (RWAs), AI & DePIN, and finally Prediction Markets. Our legacy financial system is on the verge of a complete overhaul – and all will be built on blockchain technology, as we have just seen with the launch of above examined Project Crypto. Is it too late to invest? You decide, but the revolution hasn’t even left the gate yet. I will leave you this month with Arthur Schopenhauer: “All truth passes through three stages. First, it is ridiculed, Second, it is violently opposed. Third, it is being accepted as self-evident.”

One might be inclined to follow Yoda’s advice, as can be seen in this month’s cover picture: “HODL Bitcoin” …

Thank you for your time and attention.

Sincerely,

Philipp L.P. von Gottberg