THE WORLD AS WE SAW IT IN JUNE 2025

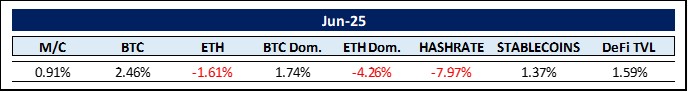

The World of Cryptocurrencies

Crypto June 2025 was all about stablecoins, hence the featured image above. It started off with US Senators Elisabeth Warren (D.Mass.) and Richard Blumenthal (D.Conn.) stating: “Big Tech companies’ issuing or controlling their own private currencies, like a stablecoin, would threaten competition across the economy, erode financial privacy, and cede control of the US money supply to monopolistic platforms that have a history of abusing their power.” What is the specific background for these well-known crypto-hating Senators to address the issuance of stablecoins by corporations? Well, Meta has done it again. Through its Instagram, Facebook and WhatsApp platforms, Meta has an astounding 3.5 billion daily users. You might remember. Meta was at it before. In 2019, Meta tried to establish its own stablecoin Libra, which was later renamed Diem. This project was rejected by the cross-party opposition to cryptocurrencies and finally shut down in 2022. Now the tide is turning: City Hall, the President of the United States, members of the Cabinet, the head of the SEC and Congress are all pushing for crypto adoption.

Exemplary for this the GENIUS stablecoin bill passed the Senate on June 17 and is now heading to the House of Representatives. If the bill passes the House of Representatives without amendment, it will land on President Trump’s desk for his signature (and he is more than willing to sign it off). Anyhow, the he Act is on track for signature before the August recess. GENIUS ACT stands for “Guiding and Establishing National Innovation for U.S. Stablecoins” and is a comprehensive stablecoin bill introduced by Tennessee Senator Bill Hagerty. According to the bill, all stablecoin issuers must back their outstanding tokens at least 1:1 with US currency, deposits at the Federal Reserve, demand deposits at a bank, government bonds with less than 93 days to maturity, or overnight reverse repurchase agreements. Notably, the act prohibits payment stablecoins from issuing a return to holders, which some argue would make them securities.

The GENIUS Act is a milestone for the adoption of stablecoins in the United States, but not all incumbents will benefit equally. The passage of the bill almost certainly undermines the long-standing dominance of Tether (USDT) in the stablecoin sector (currently 59% of the total stablecoin market). Tether’s most recent quarterly reserve report (btw from non-compliant auditing firm BDO Italia), dated March 31, 2025, shows that USDT’s supply is at most 85% backed by GENIUS-compliant reserves, below the 1:1 collateralization threshold that would be required for all payment stablecoins. Tether will have to act, and sooner rather than later, as CEO Paolo Ardoino stated in a recent interview. He could create an entirely new GENIUS-compatible stablecoin or modify USDT, but early indications are that Ardoino is not interested in the latter. Either way, GENIUS offers a great entry point for the second-placed USDC and its recently IPOed issuer Circle (24% market share) and others such as USDS and Ethena USDe.

Coming back to Senators Warren and Blumenthal and their endeavor to torpedo the GENIUS Act approval. Will companies like Meta use this new authority to issue their own stablecoins to “to fuel surveillance pricing schemes on its platform, more intrusive targeted advertising, or otherwise help the company monetize sensitive private information through sales to third-party data brokers,” as the Senators outlined in a letter to Mark Zuckerberg? At least that does not seem to be their prime motive. And it’s not just Meta. Visa (V) and Mastercard (MA) shares have plummeted after reports that major retailers including Amazon and Walmart are looking into issuing their own stablecoins to bypass traditional payment networks and lower transaction fees. This would fundamentally change merchant processing and would have a significant impact on all incumbent payment rails. Let’s see how things develop.

Anyhow, last year, the annual stablecoin transfer volume reached $27.6 trillion, surpassing the combined volume of above payment network titans Visa and Mastercard by more than 7.68%, according to a recent Coinbase report, “highlighting their realized potential for businesses as a faster, cheaper and more scalable solution for cross-border payments“. Industry estimates assume that the stablecoin market will reach a market capitalization of more than $3 trillion in the next five years (up from $253 billion now). Even Treasury Secretary Scott Bessent expects the stablecoin market to exceed $2 trillion in a few years, which corresponds to an 8-fold growth of the stablecoin market in just a few years.

According to BitcoinTreasuries.net, as of June 30, 261 corporate entities and governments hold 3.49 million Bitcoin. The majority of these are held by ETFs (1.42 million BTC), followed by public companies with 0.83 million, governments with 0.53 million and private companies with 0.29 million. Public companies recorded the largest year-on-year increase at +160%, followed by DeFi / smart contracts at +56% and ETFs at +36%. Interestingly, Bitcoin held on exchanges or custodians decreased by -34% in the same period. Reason enough to take a closer look at the fastest grower: Crypto treasury companies.

The most striking thing about these companies is that they usually trade at a premium to the assets they hold. Strategy (formerly MircoStrategy) trades at 1.69 times the value of its Bitcoin holdings; Metaplanet trades at an amazing 4.24 times. These values are known as MNAV multiples — an abbreviation for market capitalization divided by the net asset value (NAV) or total value of the cryptocurrency they hold. Ravi Kaza, Partner and CIO at Arrington Capital, recently explained this phenomenon: “Treasury strategies are inherently reflexive. The higher their MNAV valuation sustains at levels far greater than 1, the more accretion they generate when they raise capital to buy the specific treasury asset.” Theoretically, then, it is possible to own more crypto per share over time by owning crypto treasuries companies than by buying spot. Cosmo Jiang, General Partner at Pantera Capital, has done the math: If an investor buys for instance Strategy at 2x NAV, they effectively receive 0.5 BTC. However, if Strategy increases capital and Bitcoin per share grows by 50% annually (it grew by 74% last year), the stake could be worth 1.1 BTC in the second year — more than buying and owning 1 Bitcoin outright. “With that conviction, I (Cosmo Jiang) started to look for asymmetric opportunities to capitalize on the digital asset treasury trend.” Consequently, Pantera has taken positions in Bitcoin-focused Twenty One Capital, Solana-focused DeFi Development Corp, and Ethereum- focused SharpLink Gaming. Be that as it may, it still feels wrong to me (Philipp) to pay a premium for indirectly holding an asset rather than owning it directly yourself. I’m more traditionally inclined and always try to buy below NAV. Is this a Ponzi in the making?

Wall Street by now understands the value of BTC. The report ‘The Bull Case for ETH‘ (link below) by Etherealize CEO Grant Hummer now tries to show how institutions should think about the opportunity to own ETH. As we mentioned in Edition #47, Etherealize is a new institutional marketing and product arm for Ethereum that was founded in New York in January 2025 with the aim of bridging the gap between Ethereum and TradFi (traditional finance). The initiative was founded by Vivek Raman, a former Wall Street professional with experience at firms such as Nomura and UBS. Vivek is joined by former Chromatic Capital managing director Grant Hummer and the fifth richest crypto investor and founder of the Amaranth Foundation, James Fickel, as well as six other Wall Street groomed partners. Etherealize is backed by key figures in the Ethereum community, including co-founder Vitalik Buterin, and is partially funded by the Ethereum Foundation. The main goal of Etherealize is to accelerate the adoption of Ethereum among institutional players such as banks, financial institutions and large corporations, especially with regard to the promising market of RWAs (tokenized real-world assets).

Global finance is digitizing. As trillions of dollars in money market funds, government bonds, corporate bonds, stocks, real estate and even AI‑generated intellectual property move onchain, the world needs a neutral, programmable settlement layer. And that settlement layer, in the author’s (Grant Hummer) opinion, is clearly ETH. And why? ETH is a hybrid commodity-reserve asset: it is consumed like fuel, staked like a bond, used like money and hoarded like gold. ETH does not fit into a discounted cash flow model because the “revenues” (fees) are burned and not distributed: There are no cash flows to discount. Rather, ETH should be valued according to its function as scarce, yield‑bearing, non‑government commodity money that secures and regulates the settlement layer of Web3. In the author’s view, ETH is mispriced relative to its structural role. It is trading at less than 0.03 BTC and less than 40% of its 2021 peak value, even though Ethereum’s network usage, secured value and institutional penetration are all at all‑time highs. So, in the most conservative scenario, ETH simply reverts to its current value and yield. In the base case scenario, it earns a gold‑like monetary premium. In the high-conviction case, it becomes the reserve asset of an onchain economy that is larger than the GDP of many nation states. Grant Hummer makes a reasonable case, and we feel endorsed in our opinion to hold on to our current ETH position for the long term.

Here is a safe link to the 39-page report by Etherealize:

From now on, we will keep a close eye on developments in the tokenized real-world assets (RWA) market. In total there are currently $25.28 billion in assets tokenized. Private loans lead the way with $14.73 billion, followed by US treasury debt with $7.52 billion and commodities with $1.62 billion. The market for private loans is dominated by Figure with $10.96 billion in active tokenized credit assets under its belt. Founded in 2018, the company is the clear market leader in the non-bank lending sector. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) is expanding rapidly and is the leader in tokenized US Treasury securities with $2.8 billion under management. Its May distributions exceeded $10 million, bringing total dividends to more than $43 million since inception. This represented the third consecutive monthly record. Commodity RWAs are led by PAX Gold (PAXG) with gold assets nearing $933 million closely followed by Tether Gold (XAUT) with $670 million. The entire market has grown by around 50% in the first six months of 2025. We agree with Larry Fink that this is an incredibly exciting market opportunitx with exponential growth potential. Here is Peter Diamandis: “In an exponential world, those who adapt fastest win.”

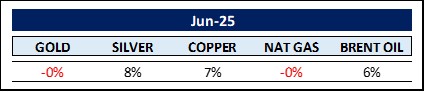

The World of Commodities

Silver quickly catches up with gold and reduces the previously growing gap. The GSR (gold-silver ratio) fell by 7.95% over the course of the month, but still remains at a historic high of 92. The oil market remained volatile due to the ongoing geopolitical turmoil. Copper continues its upward trend, perhaps in anticipation of new tariffs from the Trump administration.

The top three commodities in the first six months of 2025 were Platinum (+49%), Cobalt (+37%), followed by Copper (+26%). The bottom three start with Eggs (-54%), followed by Orange Juice (-47%) and Cocoa (-29%).

The fact that platinum has so far outperformed gold in 2025 has surprised many investors. Mind you, gold has had an amazing run, driven largely by central bank buying to hedge global instability, rising 26% since the start of the year. Platinum, however, has outperformed, rising 49% ytd and 27% in June alone. After years of underperformance, the platinum rocket has ignited. This requires a bit of a deeper dive.

Any way one puts this, it has been a difficult decade for platinum. The price was trapped in a volatile range. Every time it looked like platinum would break out to the upside and catch up with gold, it failed. The price has recovered impressively in recent months and has surpassed the 2021 highs of $1300. Is it different this time? To answer this question, we need to understand why the price was so low. In response to the diesel cheating scandal, the platinum price fell to the $750 low of November 2008 (after reaching $2,276 per ounce in March 2008) and never recovered. Certainly, the financial crisis did not help, but the loss of a major source of industrial demand was clearly the main reason for the metal’s uninspired performance.

Therefore, it is only logical that a new or renewed source of industrial demand will be the main reason for a sustained breakout. Platinum and palladium are largely interchangeable in catalytic converters for vehicles. Platinum is preferred for diesel vehicles. However, the choice of platinum or palladium has generally been driven by cost. This has changed following the diesel fraud scandal. The negative perception of the diesel fuel cycle led to the market for electric vehicles being promoted. The assumption that electric vehicles are the future ensured that the exchange of platinum for palladium did not take place.

This only changed in response to the Russian invasion of Ukraine. As Russia is the largest supplier of palladium, its supply could no longer be relied on. The Chinese vehicle market is now also developing in such a way that hybrid vehicles are the preferred concept. Whether they are plug-in hybrids or extended range EVs, they require catalytic converters. Another potential source of new platinum demand is the development of the hydrogen fuel cycle. Platinum is needed in every part of the process. The IEA (International Energy Agency) expects platinum demand from the hydrogen sector to increase by more than 600,000 ounces by the end of the decade.

Will platinum ever reach a price level higher than gold as it had in 2014? Hard to tell, but, for starters, Platinum is significantly rarer than gold, with annual production at 170 metric tons compared to 3,300 tons for gold. Then there are persistent supply deficits (e.g. 749,000 ounces in 2023, 527,000 in 2024 and an estimated 454,000 in 2025). Platinum has been undervalued relative to gold for years, with the gold to platinum ratio reaching historic highs (around 3:1 in March 2025). Investors are now taking advantage of this, and speculative funds are doubling their net long positions in 2025, according to CFTC data. Then renewed industrial applications of platinum, particularly in catalytic converters and hydrogen fuel cell electric vehicles (FCEVs), are also likely to drive demand and thus price. Whether platinum will ever surpass gold again though is written in the stars.

On May 23, 2025, Donald Trump signed not one, but four executive orders to revive the nuclear industry and ensure energy security in the USA. As Trump emphasized in his executive orders, the US has only commissioned two nuclear reactors in the last 50 years. Now the aim is to expand US nuclear capacity from approx. 100 GW to 400 GW by 2050. Today, however, almost all nuclear power plants built worldwide (87%) are based on the designs of two geopolitical rivals, China and Russia. China currently operates 56 nuclear power plants but has long launched a strategic initiative to expand capacity drastically. In 2022-24, the CCP has approved 10 new plants each year. There are currently 27 under construction. Another 10 will be added in 2025. China is the clear technology leader. They are building new Generation III+ plants in 4-5 years at a fraction of the cost of competing countries. As the race for AI supremacy towards AGI (artificial general intelligence) and eventually ASI (artificial super intelligence) intensifies, the energy requirements of AI data centers are increasing exponentially. They cannot be powered by wind and solar energy, as these data centers require base load energy – which is provided by nuclear power, coal and gas. There are still plenty of coal and gas reserves in Western countries, but putting hundreds of new fossil fuel power plants into operation somehow contradicts the idea of reducing CO2 emissions. Therefore, nuclear fission seems to be the natural solution (until nuclear fusion technology is economically available) and China is ahead of the game.

Napoleon Bonaparte is attributed with this quote: “China is a sleeping giant. Let her sleep, for when she wakes, she will move the world.“

The Rest …

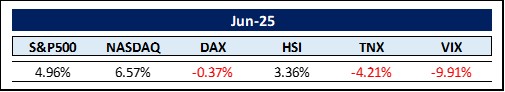

As tariff and inflation fears slowly dissipated, stock markets around the world recovered and volatility, as measured by the VIX, fell to a low of 2025. Yields on short and long-term government bonds fell.

According to a recent study by Bain Capital, private equity (PE) companies are sitting on an almost record-breaking $1.2 trillion in buyout powder. In 2017, the figure was ‘just’ $700 billion. The main reason for this increase is the general market uncertainty coupled with relatively high interest rates. Interest rates though are expected to fall this year, making PE-financed acquisitions even more profitable. After all, PE companies only use between 20% and 50% of their equity and rely on interest-bearing debt for the rest. Just recently, one of the most prolific PE firms in the technology sector, Thoma Bravo, raised a record $34.4 billion for two new funds. PE firms have an incentive to deploy capital quickly, usually within 12-18 months. So, we can expect to see a tsunami of new acquisitions as soon as interest rates come down. This will be very interesting to watch. The five largest PE firms by capital raised from 2020 – 2024 are KKR with $117.9 billion (USA), EQT with $113.3 billion (Sweden), Blackstone with $95.7 billion (USA), Thoma Bravo with $88.2 billion (USA) and TPG with $72.6 billion (USA). The focus of interest will be everything to do with AI and blockchain, which will be the driving forces in the foreseeable future.

Getting a bit more theoretical: In his 1898 book “Interest and Prices“, the Swedish economist Knut Wicksell described a monetary policy principle in which the central bank sets the nominal interest rate so that it corresponds to the ‘natural interest rate’ — the interest rate that creates a balance between savings and investment in an economy with full employment without generating inflation or deflation. If the market interest rate is below the natural interest rate, it stimulates excessive borrowing and investment, which leads to inflation. If it is higher, it dampens economic activity and causes deflation or unemployment. In other words, the yield on 10-year government bonds should represent the nominal growth rate. This is also known as the Wicksell Rule. Now, in the 1970s, we were in an era of financial repression in which the yield on 10-year government bonds was below nominal GDP.

The term financial repression was coined by the economists Edward S. Shaw and Ronald I. McKinnon and refers to government measures to manipulate the financial markets in order to channel funds into the public sector, to reduce the debt burden by shrinking debt-to-GDP ratios. Such measures reduced the debt burden from the Second World War to a rather low level in the 1970s. This was repeated after the 2008 financial crisis but came to an end during the pandemic. Debt increased along with inflation, causing the cost of servicing the debt to rise rapidly. The solution was to raise interest rates to maintain confidence in the bond market and combat inflation. The problem: To reduce government debt through inflation, yields must fall, or growth must rise. The US government is trying to increase the share of real growth in nominal growth and curb inflation to restore financial repression. This seems to be the only way to reduce the debt burden in the long term. Reshoring of industrial production, combined with productivity gains through artificial intelligence, could tip the balance. However, this is on the razor’s edge.

High-yield bond spreads, as measured by the ICE BofA US High Yield Index, have fallen to around 2.96 after rising to 4.61 on April 7, 2025. The high yield bond spread is the difference in yield between high yield bonds (junk bonds) and a benchmark, usually US government bonds with similar maturity. A narrow spread signals investor confidence, low default risk and economic growth. A wide spread indicates economic uncertainty, a higher risk of default or fears of recession. The fear that overcame investors in April was clearly triggered by the now infamous ‘Liberation Day‘ and associated tariff announcements. It seems investors are now more likely to buy into the emerging TACO meme – TACO standing for Trump Always Chickens Out. Anyhow, the ‘smart money’ is back to buying.

Moving on to the fourth-largest economy of the world: Japan. In August 2024, a surprise interest rate hike by the Bank of Japan (BoJ) shocked global financial markets and caused Bitcoin to plummet by 30%. And this rate increase was only from 0.1% to 0.25%. That was enough to unwind the so-called Yen Carry Trade which was a recipe for basically getting free money by borrowing yen at negligible interest rates and investing those funds in higher yielding assets. The question we have to ask is: will they do it again? Well, Japan has the highest debt-to-GDP ratio of any ‘developed’ country in the world at 263% and the government has had to spend 22% of its budget just to pay the interest on the unimaginable debt it has accumulated. After decades of battling deflationary pressures, the BoJ is now facing an inflation rate at 3.6%, well above its target of 2%. In this context, it is helpful to know that the BoJ owns around 50% of all Japanese debt, which it has accumulated over decades of quantitative easing. The BoJ is now planning to reduce its purchases of government bonds by around 33%, which led to the recent auction of 20-year Japanese bonds generating the weakest demand since 1987. The BoJ has now raised the key interest rate to 0.5% – but this still seems far too low. In this context, it is important to note that the BoJ holds about $1.1 trillion in US Treasury securities, making Japan the largest foreign holder of US government bonds. This represents about 14% of total US foreign-owned debt, which amounted to $7.9 trillion at the end of 2024. Tokyo-based financial analyst Weston Nakamura sees the weak demand for both long-dated US and Japanese bonds as a canary in the coal mine, pointing to a slow break-up of the global financial system. In the meantime, Bitcoin seems incredibly strong, even in the face of the mounting global fiat crisis coupled with rising geopolitical stress, suggesting that Bitcoin could actually benefit in the event of a Yen Carry Trade Unwinding Volume 2, rather than being punished in a forced liquidation.

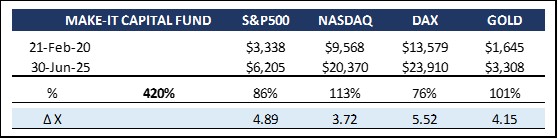

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment.

- The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- The Fund is fully transparent and always trades at the exact NAV.

It was a pretty unexcited month. Ethereum lost a little, Bitcoin gained some, the Fund gained a bit more. It feels a lot like the calm before the storm.

Bitcoin is already the sixth largest asset by market capitalization, after gold, NVDIA, Microsoft, Apple and Amazon. With reasonable regulations on the horizon, the influx of institutional, corporate and government investors will only increase and I wouldn’t be surprised to see Bitcoin ranked second in 12 months.

Thank you for your time and attention.

Sincerely,

Philipp L.P. von Gottberg