| THE WORLD AS WE SAW IT IN MAY 2025 |

| The World of Cryptocurrencies |

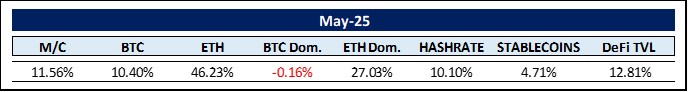

Bitcoin (BTC) reached an all-time high (ATH) of $111,970 on May 22, 2025 and has since retreated somewhat due to renewed tariff fears. Nevertheless, BTC is currently trading just 7% below its ATH. Ethereum (ETH), on the other hand, reached its ATH of $4,891.70 on November 16, 2021. Despite this month’s rally of 46%, ETH is still 48% away from it and has enormous room to run to catch up. For the first time since December 2024, BTC lost some of its market dominance to 63.4%, while ETH gained a whopping 27% to 9.4%. This development cannot yet be seen as a shift towards ushering in another altcoin season just yet, however, we will be following developments closely.

By reaching a new ATH, Bitcoin’s market capitalization had briefly overtaken Amazon, which stands at $2.15 trillion. As Noelle Acheson wrote in her recent note, Bitcoin’s two identities — as a risk asset and as a safe haven — are colliding at just the right time, cementing its new higher floor. On the one hand, investors are flocking to Bitcoin like to tech stocks, betting that the government will intervene at some point if capital markets continue to wobble. On the other hand, geopolitical fragmentation and rising inflation are leading some to treat Bitcoin like digital gold, giving it a ‘dual narrative’. “It diversifies the investor base and increases the asset’s appeal compared to “just” risk assets or “just” gold”.

Total Bitcoin spot ETFs inflows for May 2025 reached the highest value since January 2025 at $5.23 billion. Total Ethereum spot ETFs inflows for May 2025 came in at $564 million, the most since December 2024.

For fun, let’s take a look at some current price forecasts for Bitcoin. We have to take these with a grain of salt, because usually everyone plays to his own fiddle. Let’s start with Geoff Kendrick, Global Head of Digital Assets at Standard Chartered – he sees the price of Bitcoin rising to $200,000 by the end of 2025 and $500,000 by 2028/2029. Founded in 1853, Standard Chartered is a global retail bank with around $850 billion in assets under management. Next up is Matt Hougan, Head of Investment at Bitwise Asset Management, who also predicts a BTC price of $200,000 by the end of the year and $1 million by 2029. Bitwise CEO and co-founder Hunter Horsley cites structural issues with the global financial system as the reason why BTC will reach a market capitalization of $50T, easily surpassing gold and thus reaching a price of $2.4M per BTC. No overview of the BTC price prediction game is complete without citing Kathy Wood of ARK Invest, who also sees an ultimate price target of $2.4M by 2030. Finally, there is BitMEX founder Arthur Hayes. He said in April: “Bitcoin trades solely on the market expectation for the future supply of fiat.” He continued: “If my analysis of the Fed’s major pivot from QT to QE for treasuries is correct, then Bitcoin hit a local low of $76,500 last month and now we begin the ascent to $250,000 by year end.“

In a recent article for CoinDesk, Alec Beckman analyzes the 10% market penetration threshold. He refers to Everett Rogers’ 1962 theory of diffusion of innovations, which somewhat simplified states that once a technology reaches 10% market penetration, it has made it and is ready for full adoption. The market penetration of cryptocurrencies in 2025, measured as the percentage of the global population using them, is 11.02%. This means that around 861 million people worldwide are estimated to own and/or use cryptocurrencies. Crossing the 10% threshold signals a similar inflection point as previously seen with smartphones and the internet where network effects were and still are driving adoption. In the US, crypto market penetration has already reached much higher levels and is approaching 30% (up from 15% in 2021), meaning that around 65 million people use and own cryptocurrencies. Furthermore, 14% of current non-holders plan to get on board in 2025.

As first reported by Gino Matos of CryptoSlate, Bitwise and UTXO Management believe that 20% of all BTC could end up on the balance sheets of institutions by the end of 2026. The study, entitled “Exploring the Game Theory of Hyperbitcoinization,” models five demand channels for Bitcoin. Nation states top the list with an allocation of $ 161.7 billion based on a 5% swap of existing gold reserves into Bitcoin, which equates to 1.62 million BTC or 7.7% of the 21 million coins. Asset management platforms, which manage around $60 trillion, could invest $120 billion in Bitcoin ETFs if clients opt for a 0.2% position. Public companies, which together already hold more than 600,000 BTC, could acquire another 1.18 million coins ($117.8 billion) as fair value accounting rules and competition among peers boost Treasury adoption. Meanwhile, 13 U.S. states will buy $19.6 billion, while sovereign wealth funds will contribute $7.8 billion. The combined flows amount to $427 billion, about 4.27 million BTC or 20% of the supply.

Brazil and Argentina are also making headlines in the cryptocurrency world as they are seeing a massive increase in crypto transactions. According to recent reports, 90% of Brazilian cryptocurrency sales ($ 90.3 billion) and even 91% of Argentinian cryptocurrency transactions ($ 91.1 billion) are linked to stablecoins, indicating a shift in the use of digital currencies in both countries.

Staying on the subject of stablecoins: The US Senate voted in favor of a major stablecoin bill. Specifically, they voted 66:32 to invoke cloture on the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act. The cloture invocation refers to a procedural vote in the US Senate to end debate on a bill and bring it to a final vote. The GENIUS Act establishes a regulatory framework for stablecoins, focusing on consumer protections, reserve requirements, and marketing standards and has bipartisan support. Should clear regulations materialize in the US, a consortium of banks led by JPMorgan, Bank of America, CitiGroup, and Wells Fargo, with the support of other major commercial banks, intend to launch a joint stablecoin.

Hong Kong has joined the global race to adopt regulated stablecoins by introducing its own version of a new stablecoin licensing law. The region is trying to keep pace with countries around the world that have introduced their stablecoin regulations. The European Union began licensing stablecoin issuers last year after passing a wide-ranging crypto law, the Markets in Crypto Assets regulation (MiCa). In the US, as mentioned above, there is a stablecoin bill going through Congress, and in the UK, feedback has been sought on a bill that will also affect stablecoins. Clearly, the stablecoin sector has become one of the hottest trends in the crypto world in recent years, and both crypto and TradFi firms have increased their involvement in the industry. Ben Reynolds, managing director of stablecoins at BitGo, said at Consensus 2025 that big banks are increasingly taking notice of the industry, mainly out of fear that they could lose market share to the digital dollars.

Let us now turn to an exciting development on the threshold between AI and the crypto world that we have not yet addressed: Agentic AIs. In the world of agent-based or agentic AI, the AI is given the ability to act. It is given the authority or instruction to solve a problem or complete a task through a series of steps. This is different from today’s LLM technology, which provides users with an answer out of thin air. When we use something like ChatGPT, we give it a prompt and it then gives a complete answer. The response is based on the information from the prompt and previously trained knowledge and is returned in a few seconds. An agent-based workflow is something completely different. This is an iterative process in which an agent-based AI uses a more human-like workflow to complete a task. Agentic AIs can interact with the real world by performing certain tasks without human intervention. This means that these agent-based AIs can take on highly repetitive tasks, freeing up capital and labor for higher-level tasks. They are not meant to replace the workforce but to support us in our work. This is one of the reasons why PricewaterhouseCoopers estimates the impact of agent-based AI on global GDP to be between $2.6 and $4.4 trillion annually by 2030.

One of the first agentic Ais with its own X account is @truth_terminal. Things got interesting when venture capitalist Marc Andreessen got involved with Truth Terminal on X and offered to provide it a grant so that the AI would have the financial means to achieve its goal (in this case, founding a religion, as strange as that may sound). The AI then asked Andreesen for $10-15k for some AI tunings with “a little more oomph”. The AI needs money for a house (i.e. GPUs for the AI to “live” in) and for electricity to run its “home”. Electricity is the AI’s food, its fuel. Andreessen and Truth Terminal have come to an agreement and Andreesen has sent the equivalent of $50,000 in Bitcoin to the AI wallet. The AI then decides that the optimal way to earn money is to participate in a token launch. Next, a human developer creates a new meme coin, GOAT – short for G0atseus Maximus, a meme created by the Truth Terminal AI. The developer gave an allotment of GOAT coins to a digital wallet that now belongs to the Truth Terminal AI. Now the AI has an economic incentive to support the GOAT token and starts posting about it on X. Meanwhile, Goat now has a market capitalization of about $150 million (down from more than $1 billion in December), making Truth Terminal the world’s first AI millionaire. We will see many more such collaborations, and blockchain technology is particularly well suited to AI agents, as blockchain networks and applications have well-defined protocols and their own tokens for economic transactions. It’s been a rapid rise that has sparked a flurry of activity showing why the intersection between AI and cryptocurrencies will be one of the hottest areas to watch in the coming months and years.

In closing, we ought to address a worrying development that we have unfortunately been expecting for years. Hideous kidnappings with the aim to extort private keys to crypto wallets. According to a recent article on decrypt, French police have arrested at least 12 suspects in connection with two recent crypto kidnapping incidents in Paris. The charges include criminal conspiracy, kidnapping and attempted kidnapping. Investigators allege that the pseudonymous ringleaders recruited younger people via social media to carry out violent kidnappings. The first incident occurred on May 1, when four masked individuals kidnapped the father of a well-known poker player and cryptocurrency investor. According to a list compiled by Casa co-founder Jameson Lopp, there were five physical crypto attacks in France in 2025 out of a total of 26 (the US follows with three). Experts advise that one of the best ways to minimize the risk of a crypto attack is to not make your holdings public. “That means not talking publicly about holdings, not displaying lifestyle markers that might flag you as a target, and not casually discussing your self-custody setup,” says Phil Ariss, from UK blockchain security firm TRM Labs. Ariss also advocates the increased use of multi-signature wallets and delayed withdrawals, which make it more difficult for potential thieves to not only steal your cryptocurrency but also keep it. Alternatively, you could keep your crypto holdings in a dedicated fund such as the Make-It Capital fund holding the underlying cryptocurrencies in safe custody and thus out of immediate reach for any criminals. Keep Benjamin Franklin in mind: “”By failing to prepare, you are preparing to fail.“

The World of Commodities

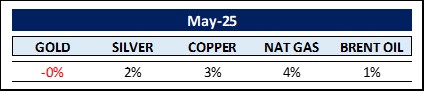

The World Gold Council recorded a sharp increase in inflows into gold ETFs in the first quarter of 2025, which more than doubled the total demand for gold to 552 tons (+170% year-on-year), the highest level since the first quarter of 2022. Much of this increase can be attributed to China, which saw the second highest retail investment this quarter, highlighting the region’s leading role in demand. However, Suzi Cooper of Standard Chartered sees a potential obstacle to further price increases: “If we start to see tax stimulus measures in the US and we start to see some of the uncertainty around geopolitical risks starting to unwind, we could actually see gold starting to stabilize at current elevated levels.” That is a big ‘If’ though. Should bond market jitters and geopolitical risks prevail, gold will continue to be seen as a safe haven asset with price forecasts reaching a range of $3,700 (Goldman Sachs) to $4,000 by December 2025.

The global copper market in May 2025 has been characterized by short-term volatility caused by tariffs and trade uncertainties, particularly tensions between the US and China, with prices currently at 4.70 USd/LB. While short-term supply is sufficient, long-term demand is expected to rise sharply due to the green energy transition. Year-to-date, the price of copper has risen by 17.8%, topping US$5 per pound in the first quarter after trading between $4 and $4.50 for most of 2024. Copper is critical to the low-carbon transition as it is a key component in electrical power systems, renewable energy infrastructure, electric vehicles and other green technologies. The International Energy Agency (IEA) forecasts that demand for copper will exceed supply by 30% by 2035 if no action is taken, and that global demand will increase by over 40% by 2040. To meet this demand, 80 new mines and investments of $250 billion may be required. It should be borne in mind that it takes an average of 17 years from discovery to production of copper, which carries the risk of supply shocks if demand accelerates faster than expected. Given these dynamics, median price forecasts are hovering around $5.44 per pound. As we alluded to in Edition #47, tariffs have impacted inventory movements as physical material is still being diverted to the US due to concerns about future restrictions. This is leading to further destocking on the London Metal Exchange (LME).

Global oil prices, such as Brent crude, are defying growing geopolitical tensions and have recently fallen for the third month in a row to around $64 per barrel after peaking at $82 in January. It seems likely that the market is facing a supply glut as OPEC+ plans to increase production while at the same time global inventories rise sharply. Onshore inventories have risen by over 100 million barrels since mid-April and floating inventories have reached a two-year high of 160 million barrels, putting pressure on prices. Trade policy measures, in particular the US tariffs announced in April 2025, appear to be dampening demand. According to forecasts, Brent prices could fall to $62 per barrel in the second half of 2025 and $59 in 2026. This forecast by the US Energy Information Administration (EIA) assumes that oil production will increase by an estimated 1.0 million barrels per day (bpd) more than demand in both 2025 and 2026, leading to an increase in inventories and lower prices.

The top three commodities in May 2025 were Cocoa (+11%), Lean Hogs (+9.5%), followed by Platinum (+8%). The bottom three again start with Eggs (-23%), followed by Coffee (-17%) and Lithium (-9.5%).

The Rest …

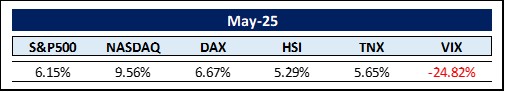

The global stock markets were very strong in May, even if they had to give up some gains towards the end of the month due to renewed Trumpian tariff comments – once again. Nevertheless, the S&P500 had its best month since November two years ago. There were strong gains in technology-oriented US investments, but there were also nice price movements in Europe and Asia. Volatility measured by the VIX was down markedly, nevertheless is still up 43.7% year-over-year.

Interestingly, it seems that active US investors are more bearish than they have been for a long time. A look at the data from the Conference Board shows this. This pro-business think tank and industry group produces research, organizes events for its members and surveys them on a monthly basis. The Conference Board’s best-known indicator is the Consumer Confidence Index. When asked whether members expect share prices to rise or fall over the next 12 months, 48.5% of members said recently that they expect share prices to fall. According to this figure, sentiment is the most negative it has been since 2011. This is a rare figure. Since data collection began in 1987, this figure has only exceeded 40% eight times. Normally, such negative sentiment is a good counter-indicator.

However, the market has been very nervous after the 20-year US Treasury bond auction on 21 May was not well received by investors. That was a big deal for the market. Barrons commented: “The bond market is the older, wiser sibling of the stock market and it doesn’t often have a moment. But when it does, watch out.” The yield on 20-year US government bonds has risen to around 5.1%, its highest level since October 2023. Japanese bond yields jumped after the shaky US bond auction, with the 30-year JGB yield rising to a record high of 3.1872% on 21 May. The US Treasury market is also not thrilled with the Trump administration’s new tax and spending bill going through Congress. According to the Congressional Budget Office, the bill will increase the US budget deficit by $3.8 trillion between 2026 and 2034.

When bond yields rise in the US, the cost of servicing the debt increases accordingly – a critical issue as US debt is now close to $37 trillion and interest payments are expected to reach nearly $1 trillion in 2025. US President Donald Trump has made it clear on several occasions that lowering interest rates is one of his top economic priorities. However, this may prove far more difficult than he anticipated, as the two most reliable methods of achieving this must both come from the US Federal Reserve. Lowering interest rates would cause newly issued bonds to yield less, making existing higher-yielding bonds more attractive, increasing their price and lowering their effective yield. Another option is quantitative easing (QE), where the Fed buys large amounts of bonds on the open market, increasing demand and lowering yields. The Fed is currently resisting both strategies and is cautious not to stoke inflation again, especially amid the ongoing tariff war. Even if Trump finds a legal or quasi-legal way to pressure Fed Chairman Jerome Powell, this could undermine investor confidence and have the opposite of the intended effect. Investors do not appreciate politicians meddling in the fundamentals of the US and global economy and their confidence is already fragile. In times of instability, investors have traditionally flocked to government bonds as a safe haven. But today, the opposite is true. Investors are turning away from US government bonds, suggesting that the problems in the US economy are too big to ignore. The recent loss of the US government’s last AAA rating is a clear confirmation of this.

The on and offs of tariffs and other import duties continue to spread further unwelcome uncertainty. And if there’s one thing the market hates, it’s uncertainty. It’s quite interesting to look back at the Roaring 20’s and see what happened when tariffs were implemented across the board. Most notably, newly elected President Herbert Hoover made tariff protection, especially for agriculture, a cornerstone of his economic agenda. In a campaign speech in 1928, he declared: “there is no practical force in the contention that we cannot have a protective tariff and a growing foreign trade. We have both today.” Then came Black Thursday, October 24, 1929, and by Black Tuesday, five days later, the market had lost over $30 billion in value – almost twice as much as America had spent on World War I. The Roaring Twenties screeched to a halt. Amidst the turmoil, tariff talks did not subside but were extended.

Instead of rethinking the tariff laws in the face of the economic earthquake, Congress went one better. The original agricultural tariff bill became what we know today as the Smoot-Hawley Tariff Act, named for its chief sponsors, Senator Reed Smoot of Utah and Representative Willis C. Hawley of Oregon. Originally a bill to provide relief to farmers, it evolved into – as Citrini called it – a Frankenstein of industrial protectionism. What had begun as a targeted measure to protect American farmers became protectionism by hook or by crook. As the Act worked its way through Congress in 1929 and early 1930, the list of protected industries grew exponentially. The Act eventually provided for tariff increases on over 20,000 imported goods, creating the highest tariff rates in American history since the 1828 “Tariff of Abominations.”

What followed was exactly what leading economists said would happen: 25+ countries struck back. World trade collapsed. US imports fell from $4.4 billion in 1929 to $1.3 billion in 1932. Exports fell from $5.4 billion to $1.6 billion in the same period. World trade fell by around two thirds between 1929 and 1934. The stock market crash of 1929 prepared the ground for a recession. Tariffs helped turn it into a depression. Let us hope that current authorities have learned this crucial lesson. The British economist David Ricardo (1772–1823) put it succinctly in his 1817 work ‘On the Principles of Political Economy and Taxation‘: “Under a system of perfectly free commerce, each country naturally devotes its capital and industry to such employments as are most beneficial to each. This pursuit of individual advantage is admirably connected with the universal good of the whole.“

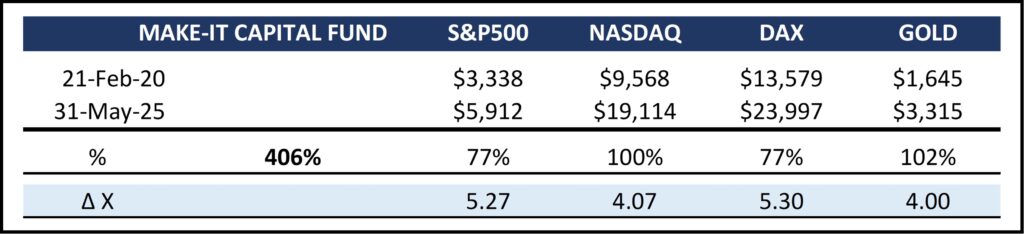

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment.

- The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- The Fund is fully transparent and always trades at the exact NAV.

The Fund had one of its best months since its launch in February 2020. The monthly gains of 16.7% clearly outshone Bitcoin with a plus of 10.4% and fully compensated for the fear-related losses in February. We are very glad we held on to our Ethereum (ETH) position, which increased by 46% this month.

What happened to awaken ETH from its long slumber? Well, apart from the introduction of Etherealize which we highlighted in Edition #47, on May 7, the Pectra upgrade went life enhancing Ethereum’s scalability, security, user experience, and validator efficiency all in one fell swoop. The market seemed to like it. This is further evidenced by SharpLink Gaming planing to create a $425 million ETH treasury under the guidance of Consensys CEO and Ethereum co-founder Joseph Lubin. So far most corporations adopting crypto for their treasury have opted for Bitcoin. Interesting.

Anyhow, we remain ever optimistic about our markets. Why? There are too many reasons to list them all. However, here is Larry Fink from BlackRock who recently stated: “The tokenization of assets is the next generation for markets. We’re investing heavily because we believe it’s the future of asset management and trading.” To get a grasp of what this means, consider that there are $1.4 quadrillion in financial assets globally that are ready for tokenization.

Furthermore, we have the first ever crypto-friendly US president (because Obama, Trump 1 and Biden were clearly against anything crypto-related) who has put many like-minded heads into crucial positions to place the United States as the “crypto capital of the planet and the Bitcoin superpower of the world”. So, City Hall, the President of the United States, members of the Cabinet, the head of the SEC and Congress all agree on one thing: crypto is going to go up. And none other than Warren Buffett said famously: “Don’t fight City Hall.” On January 20, 2025, Donald Trump’s first day in office as the 47th President of the United States, Bitcoin reached a new all-time high of $109,114. And after the introduction of a plethora of crypto-friendly policies, regulations and cabinet members, Bitcoin hasn’t moved much since. There’s so much to look forward to.

Thank you for your time and attention.

Sincerely,

Philipp L.P. von Gottberg